Environmental, Social and Governance (ESG) in the Aftermarket Automotive Parts Industry

The automotive aftermarket is a growing industry that provides parts and accessories to vehicles, including cars, trucks and SUVs. The automotive aftermarket is the secondary market for automobile parts, equipment, chemicals, and accessories sold as soon as the original equipment manufacturer (OEM) sells the vehicle to the consumer. It consists of manufacturing, distributing, remanufacturing, retailing, and installing these products. Automotive manufacturers are racing into a new world of sustainability and mobility, and technology can help them achieve both.

In recent years, ESG has become mainstream due to its importance within the investment community. It helps stakeholders understand how an organization manages risks and opportunities related to sustainability. Automotive aftermarket has an impact on the environment, supply chain, landfill and various other ESG parameters.

Since most automotive parts are sold as new or used, they often also come packaged in plastic bags. As this packaging makes its way into landfills it ends up costing taxpayers’ money. In addition to costing us money through pollution and waste management costs, these materials can take years to biodegrade before they reach our soil—which means we're living with them for longer than necessary.

Fortunately for consumers looking for eco-friendly options for purchasing aftermarket items like tires or rims (or even an entire vehicle), there are plenty of ways you can help reduce waste at home and in the workplace when buying new products from any company who sells their wares online.

ESG Impact

The product life cycle includes phases such as design, creation, production, transportation, and disposal. In each of these stages, the product consumes natural resources, such as water and energy, and emits pollution and GHG emission which eventually impact the environment. Automotive market consumes gallons of water each year and uses natural resources to produce parts for cars and trucks.

In the United States alone, around 60-70 percent of aftermarket automotive packaging ends up in landfills – amounting to over 800 million pounds of waste each year. According to estimates, only 15 percent of this waste is recycled into new products or materials, which is particularly concerning.

It's important to dispose of packaging efficiently when it comes to post-purchase automotive items. In fact, packaging is a big source of waste in our world. Packaging includes everything from cardboard cases, plastic bags and boxes, shrink wrap and bubble wrap—the list goes on.

ESG Trends

Based on the above impact, the Automotive Aftermarket industry has taken steps to reduce packaging waste by using lightweight papers for packaging, which are easily recycled and reusable to create a variety of new items. Paper is biodegradable and can be used for fuels, insulation, or even packaging. To minimize a delivery's environmental impact, it is important to use durable packaging and pick the right packaging for your products.

Long-term car ownership is on the rise, and consumers are avoiding buying new cars longer than ever before, even if they're driving traditional, gasoline-powered cars rather than hybrid or fully electric ones. This market not only offers a positive environmental impact by keeping vehicles on the road longer, but also presents an opportunity for business with the increased demand for after-market parts. When cars are out of warranty, consumers are more likely to avoid dealerships for repairs, presenting repair shops with supply chain challenges. The increasing prevalence of e-commerce also disrupts auto parts suppliers.

Keeping supply chain practices innovative is also very crucial. For example, route optimization software can help companies manage distribution networks more efficiently. It calculates the most efficient service option, maps out direct routes, and matches trucks to drivers. Some logistics providers do not offer route optimization as part of their normal solution development process. A smarter approach to warehousing and distribution benefits aftermarket supply chains as well. It is becoming increasingly common for aftermarket players to collaborate, as they realize the benefits of partnering with other businesses for greater efficiency, sometimes even direct competitors.

Another way which can be implemented is to ship auto parts only once in order to protect profits and reduce environmental impact. Whenever a part is damaged or cracked due to mishandling, it cannot be fixed — it must be replaced. As a result of the subsequent shipment, more packaging will be needed, and greenhouse gas emissions will increase.

Aftermarket suppliers and distributors are working together to turn the aftermarket into a sustainable repair and maintenance industry. Although the aftermarket plays an integral role in the automotive industry and contributes greatly to its sustainability goals, a fair and stable regulatory framework supporting open choice for consumers when it comes to maintaining and using vehicles is essential.

Future Potential

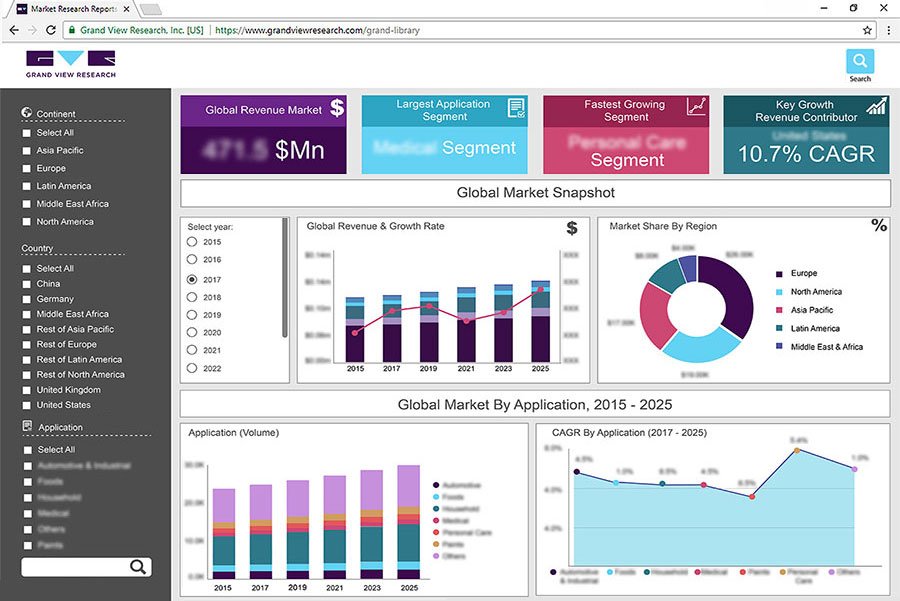

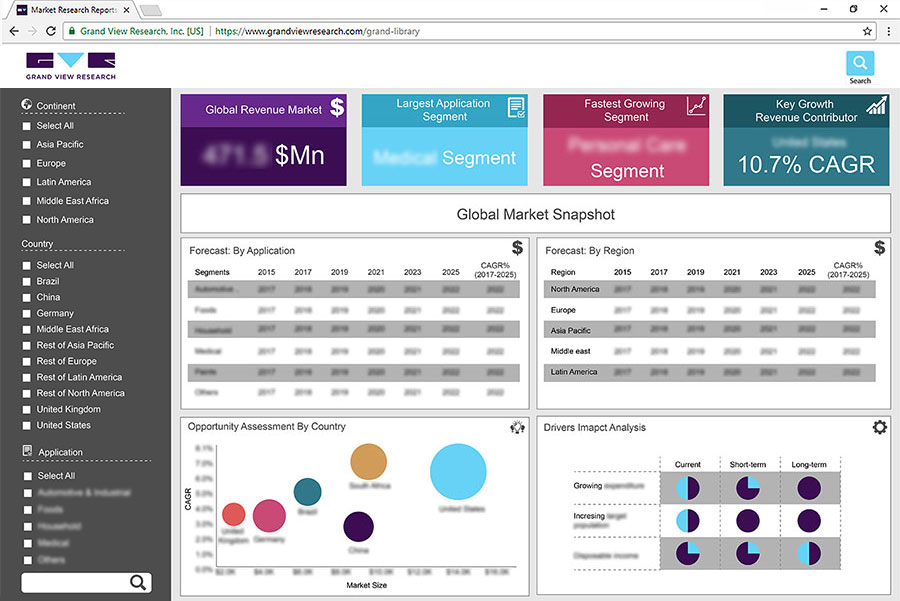

In 2021, the global automotive aftermarket market was valued at USD 408.5 billion. From 2022 to 2030, the market is expected to grow at a compound annual growth rate of 3.4%. Automobile drivers have sought to improve the performance of their vehicles in terms of exhaust sound, speed, and appearance parameters, among other parameters, which is driving the industry. Regulatory authorities in regional areas, such as the United States Environmental Protection Agency and the Japanese Automobile Sports Muffler Association (JASMA), monitor the established standards and environmental impacts of automotive components. For example, noise emission levels related to automotive exhaust systems today, such as resonators and mufflers. We have looked at some of the ways this industry is helping reduce our planet’s impact on the environment.

Key Companies in this theme

• 3M Company

• Continental AG

• Cooper Tire & Rubber Company

• Delphi Automotive PLC

• Denso Corporation

• Federal-Mogul Corporation

• HELLA KGaA Hueck & Co.

• Robert Bosch GmbH

• Valeo Group

• ZF Friedrichshafen AG

Scope of the Aftermarket Automotive Parts Industry ESG Thematic Report

• Macro-economic and ESG-variable analysis of the industry, including regulatory, policy, and innovation landscape

• Key insights on infrastructure developments and ESG issues affecting the theme

• Identify key initiatives and challenges within the industry

• Identify ESG leaders within the industry

• Understand key initiatives and the impact of companies within the sector to fuel an informed decision-making process

• Analysis of industry activities based on multi-media sources, including significant controversies and market sentiment

Key Benefits of the Aftermarket Automotive Parts Industry ESG Thematic Report

• Developing a comprehensive understanding of macro-economic, Policies & Regulations and innovations affecting the aftermarket automotive parts sector, globally.

• Key insights into Infrastructure developments and ESG issues affecting the theme.

• Identifying ESG risks and opportunities to business among leading players in the industry.

• Obtaining a clear and relevant understanding of company actions, progress, and impact and finding opportunities for investment.