Report Overview

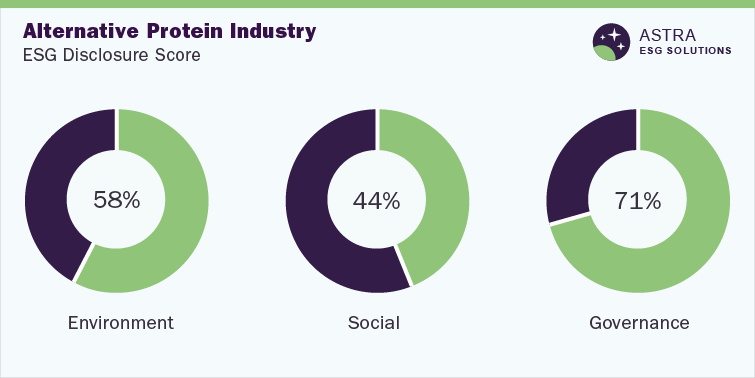

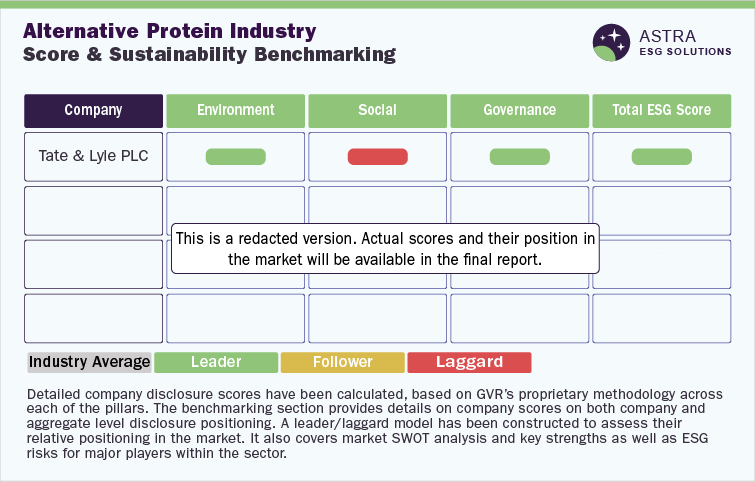

The average ESG disclosure score for the alternative protein industry is between 55% and 60%. Our proprietary ESG scoring framework analyzed 65 parameters across environmental, social, and corporate governance aspects, as represented in the methodology section of this document. Tate & Lyle PLC, Ingredion Incorporated, and four other market leaders were part of our research. Three of the six companies we researched scored well above the average industry score. However, one company needs to improve its focus on environmental and social metrics, as it scored well below 35% on both.

There is a large scope for improvement among most players in the market in terms of social performance, specifically in improving occupational health & safety and the gender pay gap. Our research confirms that the majority of sustainability-related disclosures have been made around governance and environmental metrics,followed by social metrics. From an ESG performance perspective, Tate & Lyle PLC is the leader in this sector, followed by DIC Corporation & Glanbia PLC, among others.

Environmental Insights

In recent years, innovative protein product manufacturers have focused on providing nutritional and sustainable food for consumers who seek alternative products, such as cultivated meat, a substitute for traditional meat products. These proteins are plant-based or lab-grown alternatives to animal-based proteins for daily diet. Legumes, nuts & seeds, grains, soy, mycoprotein, and cultured meat are some of the commonly available alternative proteins in the market.

Environmental KPIs are well-regulated by the board-level committees in the industry, which helps define the accountability of a company. A committee on the board dedicated to climate change is one of the most efficient strategic approaches to address climate-related risks; this seems to be a popular opinion among industry leaders.

Companies in this sector are also committed to their responsibility of waste management, as we found that all the identified players have operational waste management plans in place. The Taskforce on Climate-Related Financial Disclosures (TCFD) framework is found to be followed by all the players in the industry. Around 80% of the profiled companies have stated that they follow TCFD frameworks, which allows them to disclose climate-related risks and take appropriate measures.

The top three players in the environmental pillar are DIC Corporation, Tate & Lyle PLC, and Archer-Daniels-Midland (ADM). DIC Corporation and Tate & Lyle PLC have demonstrated their commitment to resource efficiency by achieving ISO 14001 certification.

Nevertheless, companies in the alternative protein market were found lagging in conducting scenario analysis in alignment with the Paris Agreement, which implied the possibility of future risks & missed opportunities. In addition, the lack of use of renewable energy stands as a weakness in the industry; only 50% of the profiled companies in the alternative protein industry have disclosed renewable energy use and targets. Clean, renewable energy sources are vital for companies and can help reduce the adverse effects of climate change.

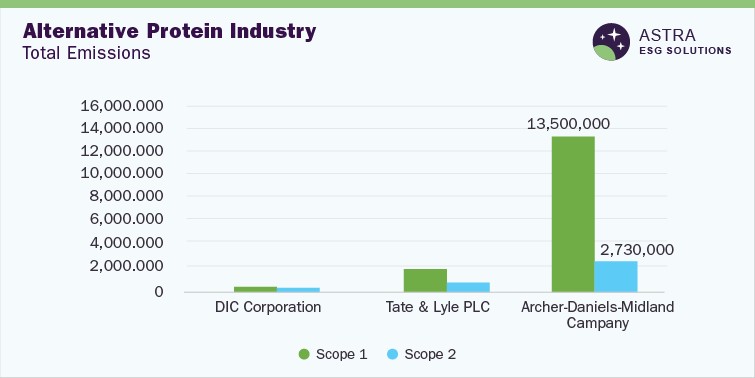

On the other hand, the industry players have fairly addressed GHG emission disclosures, allowing them to track their GHG emissions and accordingly conduct positive actions to reduce them. Around 66% of the profiled companies in the alternative protein market have disclosed emissions-related information, including scope 1 and 2, which can help track & reduce GHG emissions. Among the top three companies in the environmental pillar, ADM recorded the highest scope 1 and 2 emissions. In contrast, DIC Corporation recorded the lowest scope 1 and 2 emissions for 2020. However, Tate and Lyle PLC reported the highest emissions intensity value, while DIC Corporation recorded the lowest emissions intensity value for 2020.

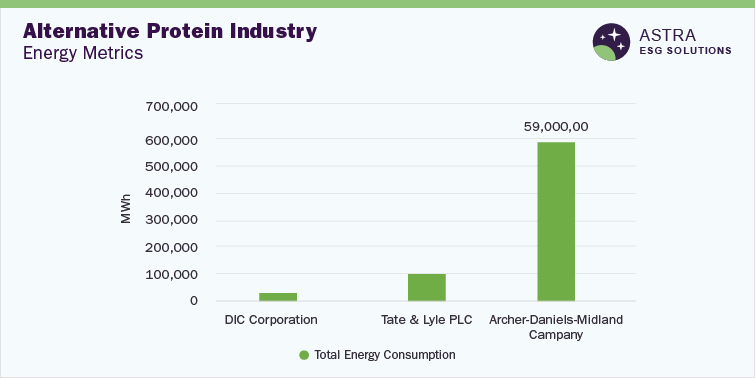

Similarly, energy consumption is tracked efficiently in the industry, and companies seek to achieve resource efficiency. Around 66% of the profiled companies in the alternative protein market have disclosed information related to energy consumption, which helps a company identify & overcome the negative impacts. Among the top three companies in the environmental pillar, ADM recorded the highest energy consumption, while DIC Corporation reported the lowest energy consumption for 2020. The low energy consumption by DIC Corporation can be attributed to the increase in the use of renewable energy. However, Tate & Lyle PLC reported the highest energy intensity value, while DIC Corporation reported the lowest for 2020.

With respect to environmental benchmarking, the following charts compare the scope 1 and scope 2 emissions, along with the emission intensity (total emissions graphs) and energy metrics of the top three companies in this category:

Social Insights

The social metric assesses the risk to a company from the perspective of community and human capital, which includes employees, stakeholders, & the relationship with them. This category includes covering employee & safety parameters through OHSAS certifications, injury rates, employee training & development, employee engagement programs, privacy, supply chain transparency, and human rights.

All the profiled companies in the alternative protein market have emphasized supporting diversity and inclusion in the workforce, with futuristic targets to increase the scope of inclusion. Career development and training programs are prioritized, which can holistically enhance business productivity and add to the overall value of the business.

All the profiled companies in the industry are committed to ensuring a safe working environment by implementing human rights policies across the supply chains and a separate supplier code of conduct. Around 50% of the profiled companies conduct audits for corruption in their supply chain.

There is an opportunity to achieve higher disclosure levels on the social matrix by focusing more on KPIs, such as injury rates, health benefits, and work-life balance. However, customer and employee satisfaction surveys are still lagging; they can help gain competent customer & employee engagement levels in the industry. None of the companies has made disclosures regarding customer satisfaction and employee satisfaction as of FY 2021.

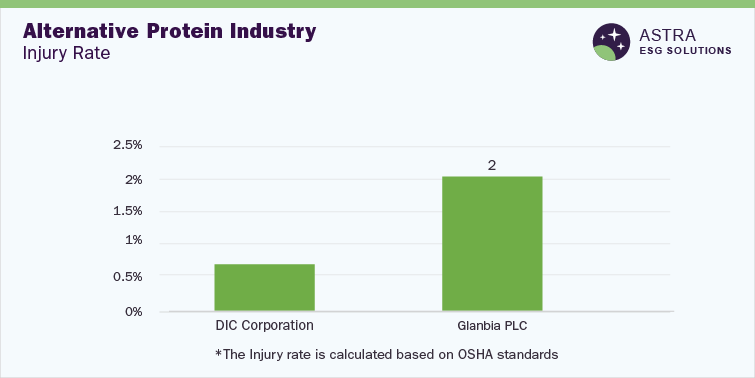

Under social benchmarking, the following chart provides a brief comparison of the injury rate among the top companies in this category:

Governance Insights

Corporate governance practices are core to an organization, as understanding opportunities and risks in governance is critical for decision-making. Governance is one of ESG’s core components and assesses the purpose of a corporation, the role of directors, the make-up of directors, gender diversity, equity, and compensation of boards. The leading entity in the industry has achieved 100% on our disclosure scoreboard, whereas the lowest disclosure score on the scale for one of the players is 51%.

Clawback policy, Business Continuity Plan (BCP), and re-election mandates for board members are some of the policies diligently followed by industry players, which makes governance the strongest of the three ESG pillars. Implementation of a code of conduct is taken seriously in the industry as all six leaders have disclosed their code of conduct, which helps maintain compliance & ethics by instilling safety policies, such as anti-bribery, insider training, & conflict of interest.

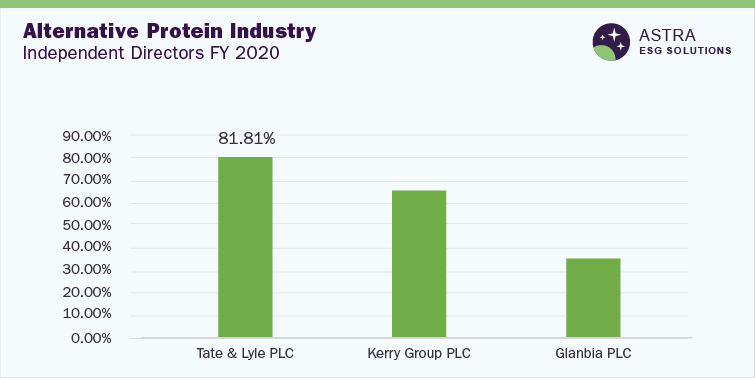

With respect to governance benchmarking, the following chart provides a brief comparison regarding female representation on board among the three companies:

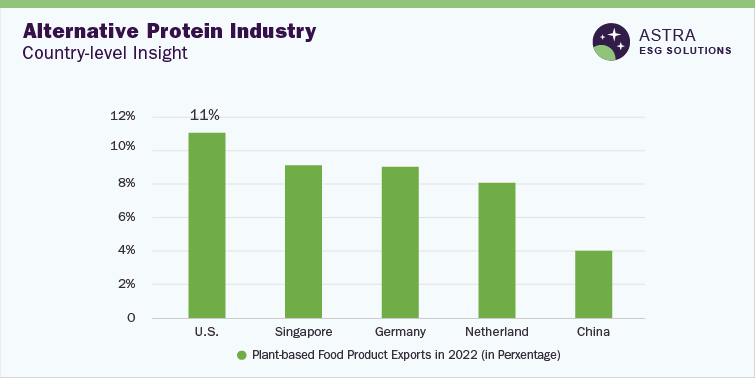

Country-level Insight

On a global scale, the top countries in the alternative protein market are the U.S., Germany, the Netherlands, Singapore, and China. Within the alternative proteins industry, North America dominates growth in the plant-based protein supplements market in terms of revenue, which is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.8% from 2022 to 2030. This can be attributed to the presence of large-scale plant-based protein manufacturers, the increasing health awareness, and the growing inclination for vegan diets among consumers. Around USD 69 billion worth of plant-based foods were exported globally, of which exports worth USD 8 billion came from the U.S. to Asia as of 2021.

In Asia, most of the investors promoting alternative protein are from Singapore, making the country a favorable destination for stakeholders. Singapore and India are the two countries in Asia that have approved cell-based meats. In China, soy protein is the largest segment in the alternative protein sector. Increasing interest in alternative meat and proteins among consumers is a fundamental driving factor.