Environmental, Social and Governance (ESG) in the Dairy Product Industry

In the current scenario, implementation of environmental, social and governance on investment platform as well as strategy building, or decision-making process contributes to a responsible investing. Growing awareness of ESG among various stakeholders from consumers to investors have been prevailing since 2013.

the market has been gaining attention as consumer are preferring dairy products as substitute for meat as it provide necessary protein enrichment. Moreover, some dairy products are nutritious as they contain calcium, riboflavin, Vitamin D, vitamin A, Niacin, Potassium and Phosphorus. Dairy products have a positive health impact(SDG 3- Good Health and Wellbeing) as it reduces cardiovascular disease and diabetes (Type 2). Companies are focusing on circularity(United Nations’ Sustainable Development Goal (UN SDG) 12 - Responsible consumption and Production) in terms of packaging and reducing plastic use. In addition to that companies focus on minimizing food waste via innovative technology and close collaboration with customers and suppliers. The Dairy Products have been in cohesion with a responsible market labelling (SDG 12- Responsible consumption and Production) which is defined by regulatory body with no compromise for product quality. However, Dairy product market have been contributing high methane emission which has been a rising concern for climate change (SDG 13- Climate Action).

ESG Trends

This segment has both Social and Environmental impact in the society, generally it does have a positivehealth impact (SDG 3–Good health and Wellbeing),in fact it reduces risks of cardiovascular diseases, diabetes as well as improves bone and gut health. Even though Milk is not preferred for consumers with lactose intolerance, by products like cheese can be an excellent source of calcium. Curd has been preferred for gut diseases like diarrhea and food poison since it is high in lactobacillus. Impact of consuming dairy products, especially cow milk consumption in early childhood could increase risk of overweight and obesity in later stage. However, if such high protein intake has been consumed later childhood results in lower Body mass index in later stages of life. Dairy products have been growing demand along with greater expectation, this segment has no compromise for product Quality as well there is a strong assurance of responsible market labelling (SDG 12- Responsible Consumption and production) as per various government guidelines like FSSAI, Animal products Dairy Regulation (2005). These industries are in the progression of Circular or sustainable packaging (SDG 12- Responsible consumption and Production) using innovative technology and close collaboration with customers and suppliers. As single use plastic ban has been on place, circular packaging has been on significant trajectory along with food waste reduction.

ESG Challenges

Main challenges for dairy products can be discussed as follows; Firstly, dairy Product industry has been highest emitter for methane emission along with meat industry. Studies shows dairy cows emits high levels of methane (SDG 13- Climate Action) which is a major source of greenhouse gas emission. Secondly Animal Welfare has been a critical area of assessment for dairy product segment as dairy products are high in demand, high production rate of milk is also required simultaneously. Availing a uniformity in milk production throughout has been challenge as it depends on food and nutrition intake, season and even psychology of dairy cows. Business model must ensure this non-uniformity of milk production. Thirdly, we can see Dairy product groups especially in India backing out or delaying of ban in Single Use Plastic, especially plastic straw. Obviously, Dairy Product industry is one among leading and large-scale industry, it is very hard to shift to reusable or degradable materials. Finally, recent studies indicate consumption of high intake protein like cow milk or milk products at early childhood could lead to obesity and overweight at later stage which made consumers to rethink on milk consumption for infant or children.

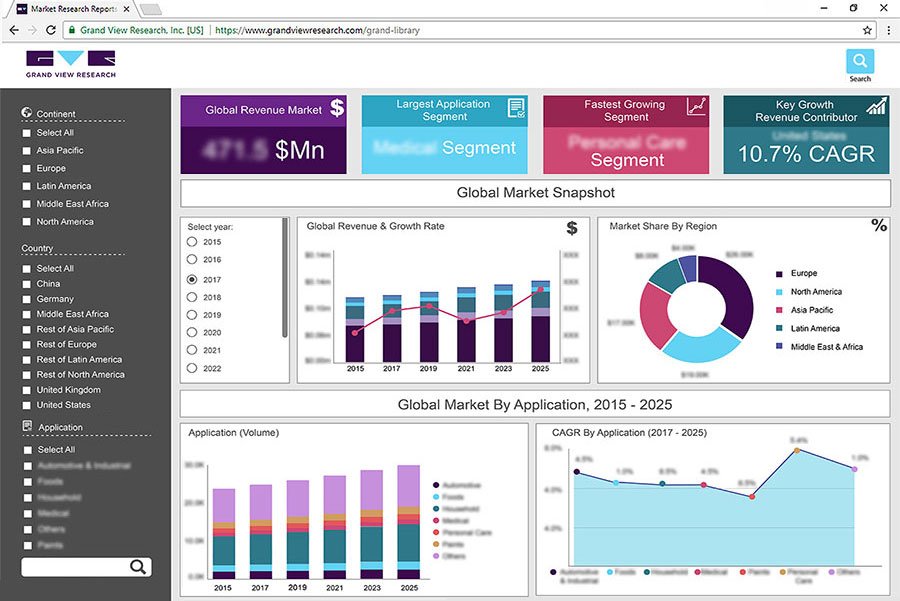

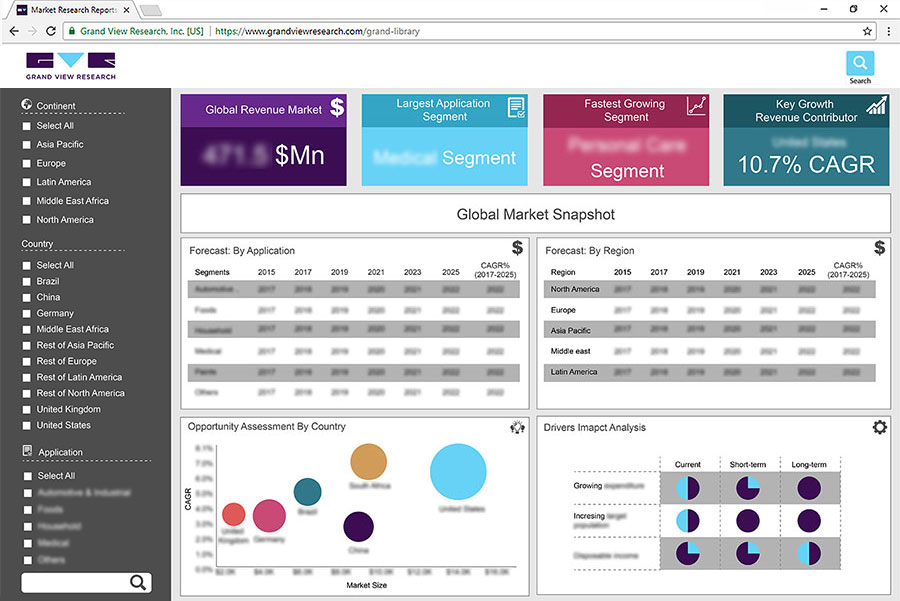

Growth of the Dairy Product Market

Dairy Product market has been growing very rapidly, as it has been profoundly being a substitute for meat products. Moreover, it provides amble enough nutrition like calcium, riboflavin, necessary vitamins etc. in comparison with other products. Even though there are lot of challenges in this market, as there is growing demand for vegan milk products derived from almond, soy or coconut milk, this segment has been one of the leading market revenue generators. The Dairy market is expected to grow at a Compound Annual Growth Rate (CAGR) of 2.5% from 2020 to 2027 and it has been valued at 481.08 billion USD in 2019.

Key Companies in this theme

• Arla Foods amba

• Fonterra Co-operative Group

• GCMMF

• The Kraft Heinz Company

• Nestle S.A.

• Danone S.A.

• Royal FrieslandCampina

• Dairy Farmers of America, Inc.

• DMK Group

• Meiji Holdings Co., Ltd.

Scope of the Dairy Product Industry ESG Thematic Report

• Macro-economic and ESG-variable analysis of the industry, including regulatory, policy, and innovation landscape

• Key insights on infrastructure developments and ESG issues affecting the theme

• Identify key initiatives and challenges within the industry

• Identify ESG leaders within the industry

• Understand key initiatives and the impact of companies within the sector to fuel an informed decision-making process.

• Analysis of industry activities based on multi-media sources, including significant controversies and market sentiment

Key Benefits of the Dairy Product Industry ESG Thematic Report

• Developing a comprehensive understanding of macro-economic, Policies & Regulations and innovations affecting the dairy product space, globally

• Key insights into environmental developments and ESG issues affecting the theme

• Identifying ESG risks and opportunities to business among leading players in the market

• Obtaining a clear and relevant understanding of company actions, progress, and impact and find opportunities for investment into the sector