Industry Sustainability Outlook

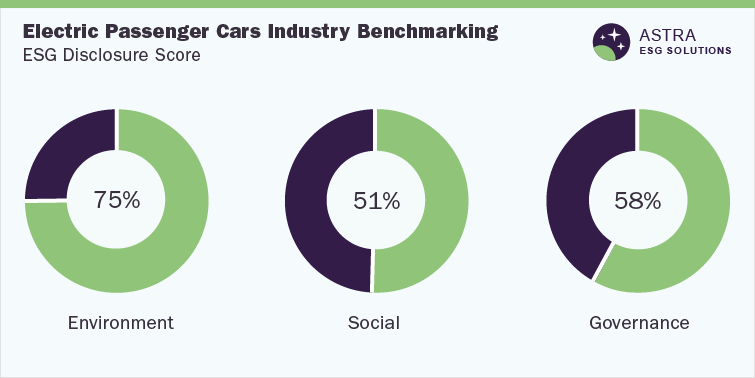

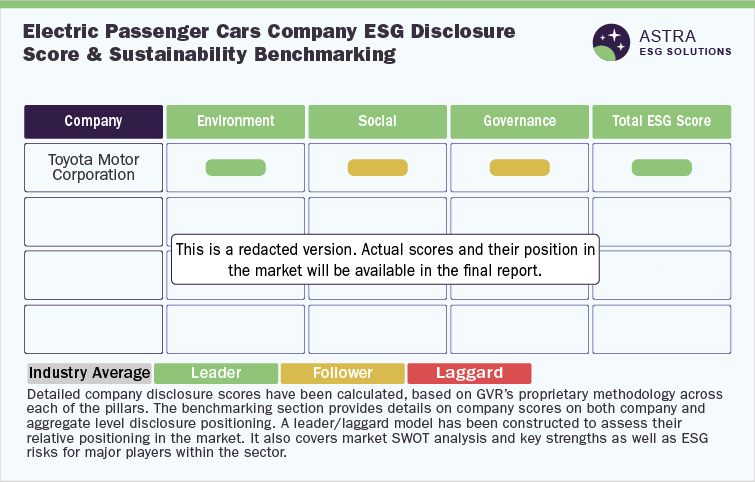

The average ESG disclosure score for the electric passenger cars industry is between 60% and 70%. Our proprietary ESG scoring framework analyzed 65 parameters across the environment, social, and corporate governance, as represented in the methodology section of this document. General Motors (GM), Mitsubishi Motor Corporation (MMC), and seven other market leaders were part of our research. Seven out of nine companies we researched scored above the average industry score. However, two market leaders need to focus more on ESG reporting and transparency as they scored well below 50%.

Suggestively, there is a large scope of improvement for major players in the market in terms of social and governance performance. Our research confirms that the majority of sustainability related disclosures have been made around environmental metrics, which are above 70% score, followed by governance and social metrics. From an ESG performance perspective, Toyota Motor Corporation is the leader in this sector followed by GM, and MMC, among others.

Environmental Assessment

In recent years, Electric Vehicles (EVs) have become more popular, which has been good news for the environment. Switching to EVs helps in avoiding the exhaustion of finite resources and also provides another way to reduce carbon footprint because these vehicles have no tailpipe emissions, which is a direct contributor to global warming.

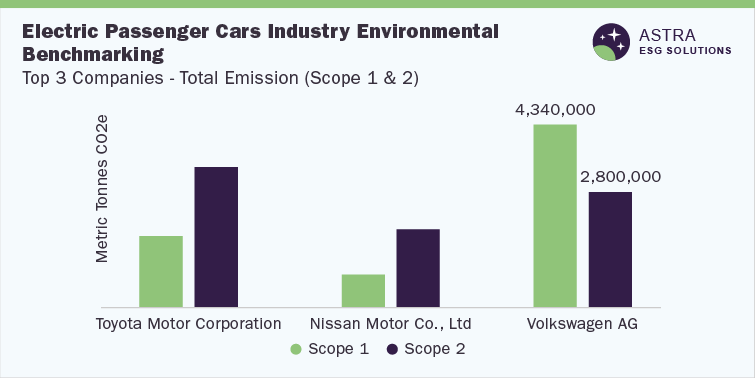

Companies in the EV market have institutionalized stringent targets to fight climate change and global warming. Most of the players like Nissan motors have programs for managing waste and reducing water consumption through the 3R (Reduce, Reuse, Recycle) and Circular Economy models. More importantly, all players have acknowledged their targets to achieve carbon net neutrality by actualizing a declining trend in the Scope 1 and Scope 2 emissions over the years. For example, one of the top three companies, General Motor Company, has been able to reduce Scope 1 and 2 emissions significantly over the years. It has a target of reducing its overall Scope 1 and 2 emissions by 72% by 2035, compared to the 2018 baseline.

With respect to environmental benchmarking, the following chart compares the scope 1 and scope 2 emissions of the top three companies in this category

One of the other top three companies, MMC, has established progressive initiatives and plans demonstrating its environmental commitment. The company manages its water risk through regular assessments and has established a sustainability committee chaired by its CEO. The company checks the progress of its goals and resolves material issues by using Total Quality Management tools, which include Plan-Do-Check-Act (PDCA) cycle. Furthermore, apart from the top three companies and Volkswagen, the remaining players in the industry lack ISO 14001 certification, which ensures proper environmental systems/processes across organizations. Among the top three companies, 100% of Toyota’s and Nissan’s plants/facilities are ISO 14001 certified, whereas GM has only 20% ISO 14001 third-party certified.

Social Assessment

Social metrics assess the risk to a company from community and human capital, which include employees & stakeholders and their relationship with them. Employees’ and safety parameters covering OHSAS certifications, and injury rates, alongside employee training & development, employee engagement programs, privacy, supply chain transparency, and human rights are majorly included in this category. With a social disclosure score of 67%, Toyota Motor Corporation ranks the highest. Most of the companies, including the top three, have separate supplier CSR guidelines or human rights policies aligned with the United Nations Guiding Principles on Business and Human rights, except Volkswagen AG, which lacks a separate supplier code of conduct on human rights or any such supply chain policy. Both Toyota and MMC conduct customer satisfaction surveys and disclose satisfaction scores, except Volkswagen. There is significant scope for improvement among other companies within the sector with regards to monitoring customer satisfaction.

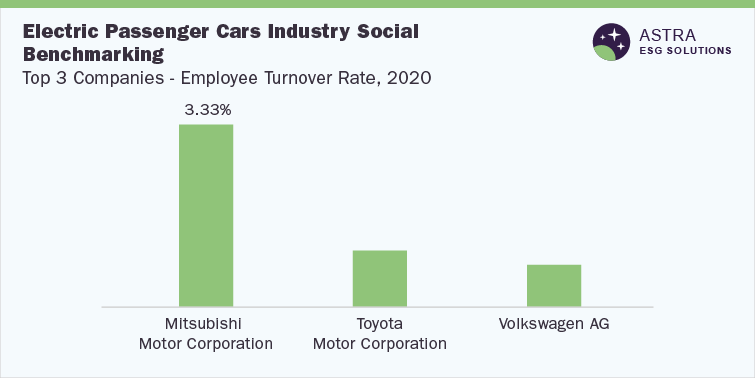

Under social benchmarking, the following chart provides a brief comparison of the employee turnover among the top three companies

Despite having the highest social score among other players in the industry and recording the highest number of training hours, based on the geographical location of employees (17.2), MMC recorded the highest employee turnover in FY2020. The company recorded 3.33% employee turnover in FY2020, much higher compared to Toyota and Volkswagen, which recorded 1% and 0.74% employee turnover in 2020, respectively. Furthermore, both Toyota and Volkswagen are ISO 45001 certified–with respect to safety certification—whereas MMC has not disclosed any safety certification; thus, calling for improved disclosure and reporting in terms of safety training of employees in the industry.

Governance Assessment

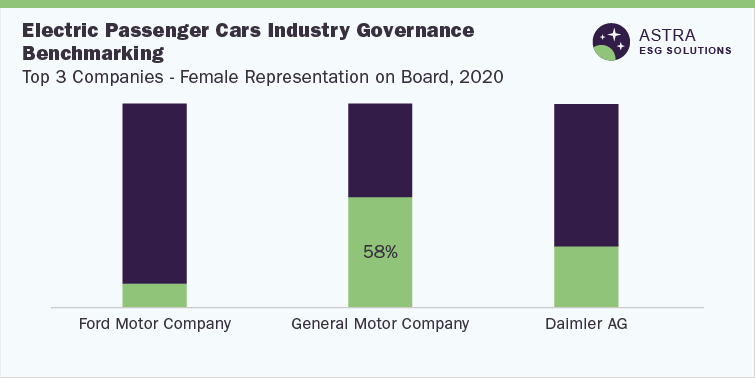

Corporate governance practices are core to an organization as understanding opportunities and risks in governance is critical for decision-making. Governance is one of ESG’s core components and assesses the purpose of a corporation, the role of directors, the make-up of directors, gender diversity, equity, and compensation of boards. Independent directors on the board play a crucial role in improving governance standards and corporate credibility. In 2020, GM had the highest representation of independent directors on board with over 90% independent directors on its board. Furthermore, in terms of diversity in the board, GM had the highest percentage of females on board, with more than 50% female members on board. Overall, in terms of governance disclosure, Ford Motor Company has the highest disclosure percentage, followed by Nissan Motor and Toyota Motor Corporation.

With respect to governance benchmarking, the following chart provides a brief comparison regarding female representation on board among the top three companies

Ford Motor Company and GM, with a governance score of above 70%, are industry leaders in this category. Ford has a robust cybersecurity program for protecting its stakeholders, while GM along with MMC has a cybersecurity committee in place for the data security of its employees and customers. Complying with the legal and regulatory requirements can be an area of improvement for companies in this industry. For instance, Volkswagen’s involvement in emissions-cheating continues to affect stakeholders like customers, suppliers, & investors and, moreover, puts employees at the risk of job cuts. In such cases, a Business Continuity Plan (BCP) would be essential, which has been developed by MMC and Ford through PACE programs.

Country ESG Outlook

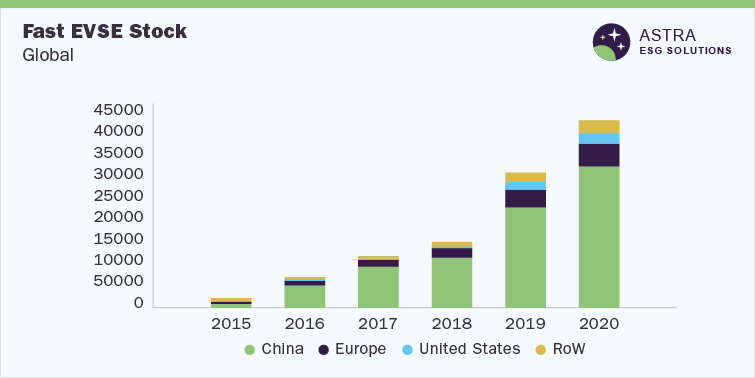

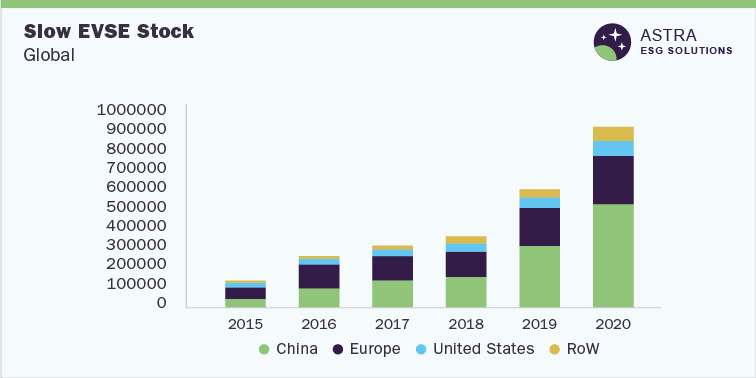

Considering the significance of EVs in reducing emissions worldwide, various economies world over aim to promote EVs through policies and initiatives. For instance, in the U.S. and some parts of Canada, a Zero-Emission Vehicle (ZEV) mandate is in place, wherein all carmakers are required to sell a certain percentage of new vehicles with zero tailpipe emissions. Other countries with mandates promoting EVs are China, Japan, and the UK. The European Union has a regulation for monitoring the performance of CO2 emissions in passenger cars. On the other hand, countries like India, South Korea, & Brazil are providing tax rebates and subsidies to customers purchasing EVs. However, to further encourage the use of EVs, a robust infrastructure is required for charging vehicle batteries. China is one of the leading countries along with the U.S. in terms of the installation of charging infrastructure. Both these countries together have installed more than 800,000 charging points.

The leading countries with accessible Fast Electric Vehicle Supply Equipment (EVSE) charging ports and Slow Electric Vehicle Supply Equipment (EVSE) charging ports are shown in the graph below

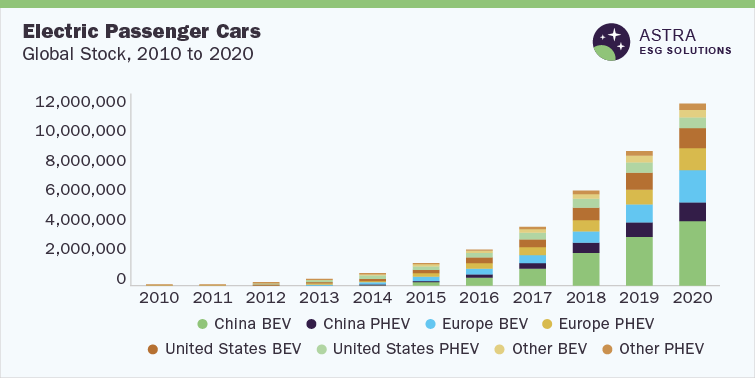

Electric Passenger Cars Market overview

As of 2020, the global EV market was valued at USD 120.81 Billion, and, at a Compound Annual Growth Rate (CAGR) of 32.5%, the market is expected to grow rapidly from 2021 to 2028. EVs are considered a prominent technology for reducing air pollution. Furthermore, their adoption has gained traction across several countries, with the increase in fuel prices. In 2020, the battery EV segment accounted for more than 50% of revenue, with an approximate sale of 3 million units in 2020. Compared to 2019, EV sales increased by more than 40%, showing a significant surge in their demand. Furthermore, as of 2020, globally, there are around 1.3 million slow and fast chargers. With various countries and companies transitioning to cleaner technology, the EV market aims to promote a positive impact on the environment, and this is evident with the increased ESG reporting over the years with regards to policies, code of conduct, targets, and development programs by companies in this sector.