Report Overview

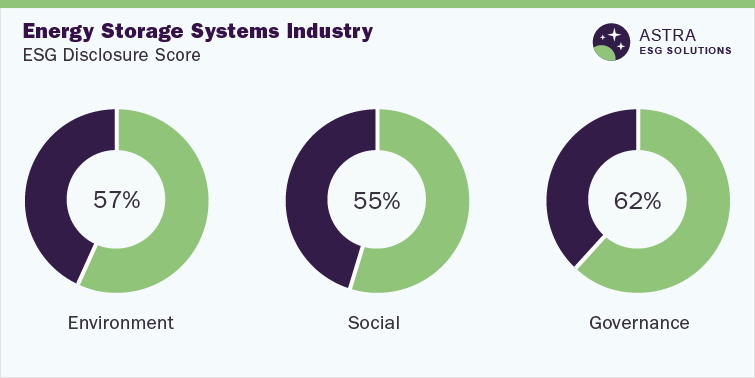

The average ESG disclosure score for the energy storage systems industry is estimated between 50% and 60%. This score was obtained after analysis of more than 60 Environmental, Social and Governance (ESG) parameters within our ESG scoring framework. Alongside Toshiba Corporation and Samsung SDI Co. Ltd, eight other market leaders were included in our research. This study identified only five companies, including Toshiba Corp. and Samsung, that scored above the average industry score, while the other five leading companies needed to improve their ESG transparency and reporting; moreover, one of the companies scored below 40%. The research found that the majority of the ESG disclosures were made with regard toboth environmental and social metrics, with Toshiba being the leader in this sector when compared to other companies, such as Samsung SDI and LG Chem, from an overall ESG disclosure point of view.

Environmental Insights

In recent times, fossil fuels are increasingly being replaced by renewable energy sources or low-carbon sources, which has encouraged top companies, especially companies operating in the energy storage systems market, to adapt to renewable energy technology. Environmental impact has become a critical factor; therefore, analyzing companies’ environmental parameters is considered one of the most important aspects from an ESG viewpoint.

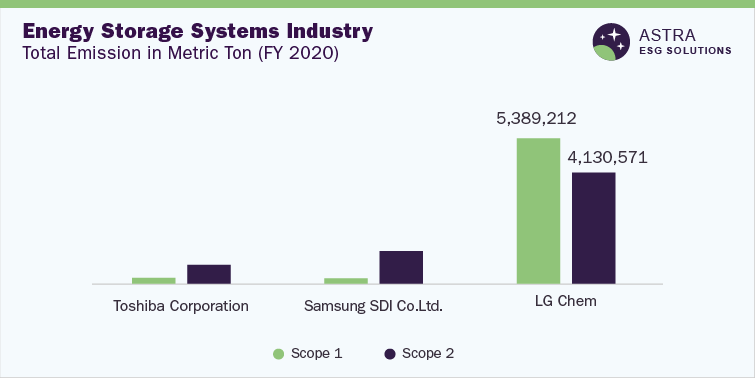

Among the ten firms profiled in our research, Toshiba Corp. leads the environmental disclosure with around 90% disclosure score followed by Samsung SDI and LG Chem. In terms of emissions, 90% of the companies profiled in the research have disclosures around scope 1 and 2 emissions, board oversight on climate-related issues, aligned with the Task Force on Climate-related Financial Disclosures, and have a waste-management program in place.

Among the top three firms in the research, Samsung SDI reported the least emissions, which may be due to its ongoing commitment toward green energy transition. For scope 2 emissions, Toshiba scored the lowest among the top three because of its efforts to invest in energy-saving equipment, introduce clean energy equipment, purchase power produced from clean energy, and more such initiatives. The following figure represents scope emissions for the top three companies.

More than 60% of the companies profiled in our research have disclosed water management programs and are certified to an Environmental Management Certification such as the ISO 14001 certification. Among the top three firms, Toshiba has clearly depicted the number of sites that are ISO 14001 certified. In contrast, the other two companies have yet to make any accurate disclosures about this.

All the top three firms have initiated a number of water management programs; for example, Samsung SDI has taken effective measures to manage water within its organizational boundaries with a target to reduce water intake by around 25%. The company reduced the net freshwater intake by 1.5 million cubic meters at its Devnya plant in Bulgaria in 2020 compared to the consumption in 2019. Water recycling, rainwater harvesting, institutionalizing water management policies, and using risk management tools are some effective measures taken by firms in this industry to manage water.

Despite the positive disclosures in the environmental pillar, companies in this industry have opportunities to improve disclosures around the volume of water recycled in their facilities, disclose waste-related targets, and disclose targets to improve renewable energy consumption in their operations. As of 2021, only around 20% of the firms profiled in the industry have made disclosures surrounding these metrics, according to our research.

Social Insights

In terms of social disclosures, around 90% of the companies profiled in our research have a supplier code of conduct in place to improve supply chain sustainability and avoid human rights violations in the supply chain. Considering the top three leaders among the 10 companies, Toshiba Corp. dominates the social segment with a 90% disclosure score, followed by Samsung SDI and Duke Energy Corporation. All three have an externally disclosed supplier code of conduct, which integrates human rights principles.

Considering disclosures on employee turnover rate, around 60% of the firms in the industry have made disclosures. However, considering work-related incidents, only 40% of the firms in the industry have made disclosures.

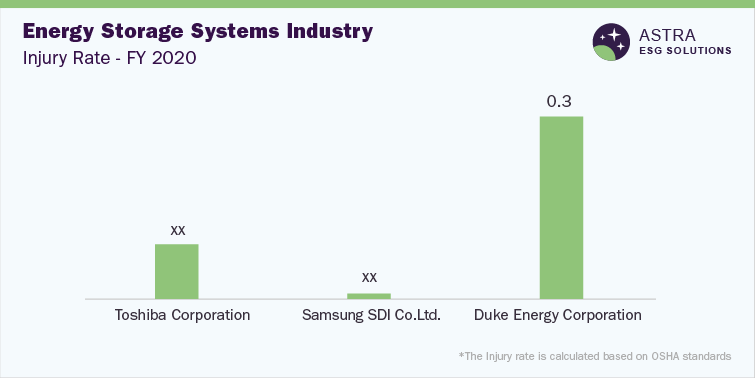

Among the top three firms in the energy storage systemsindustry, all of them have disclosures around the injury rate. The graph below shows the corresponding values for the total injury rate per 200,000 working hours for the top three companies, which shows that Duke Energy recorded the highest injury rate compared to other top three companies in FY2020. Samsung SDI showed positive development in 2020 compared to other companies with the least recorded injury rate in 2021, with multiple initiatives or programs having been implemented to reduce injury rates, including having an ISO 45001 Occupational Health and Safety Certification.

Duke Energy does not possess any safety certifications, such as ISO 45001/OHSAS 18001 standards; however, the other two companies among the top three have been certified with regard to the same. In terms of career development, 90% of the firms profiled in the industry have institutionalized career development programs. Among the top three, all of them ensure employment quality through practice-based onboarding courses for new employees, leadership training programs to develop future leaders, and foreign language courses. In addition to virtual training, Samsung SDI offered support to employees interested in obtaining national and international certifications.

Governance Insights

In terms of governance, the energy storage systemsindustry has provided maximum insights around director independence, board oversight on climate-related disclosures, and integration of human rights policies. Xcel Energy, Inc. dominated in terms of governance factor by 80%, followed by Duke Energy and Eversource Energy. Independent directors help the company enhance corporate credibility and governance standards.

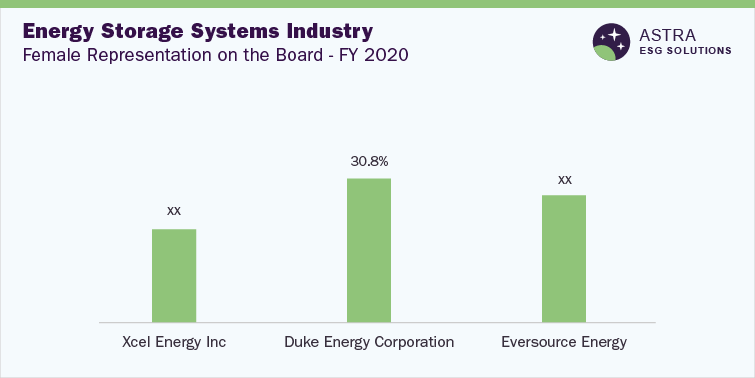

Among the top three companies, Xcel Energy had the highest percentage of independent directors within its board in 2020, while Eversource Energy had the lowest. In terms of women representation on the board, Duke Energy had the highest percentage of women among its board of directors for FY2020 compared to Xcel Energy, which reported the lowest percentage of female employees. The following graph illustrates how Duke Energy places greater emphasis on board diversity than its peers do.

A code of conduct is vital for monitoring the supply chain and increasing the brand value and engagement of a firm. All ten companies profiled in our research have a code of conduct policy in place. All the top three companies had performed well in furnishing business ethics & policies.

There was uniformity among employees from top to bottom of the organization, as well as a list of management principles for smooth, transparent, and fair operation. For instance, one of the leading firms in the industry, Duke Energy, conducts an ethical training program, which is required to be completed by all employees within the first 30 days of employment to understand and learn about the code of ethics.

Each company must possess a well-furnished Business Continuity Plan (BCP) to sustain itself in the market in terms of any natural disasters such as a pandemic. However, less than 50% of firms in the energy storage systems industry have disclosures regarding BCP. Similarly, only 40% of the companies in the industry have a succession plan for the board of directors. Companies in this industry also have an opportunity to link the variable pay with the ESG performance of a firm and incorporate cybersecurity programs in the firm.

Country-level Insights

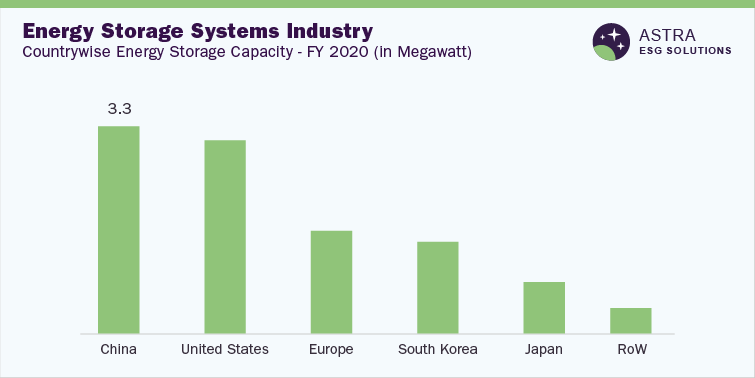

Considering the countries with the largest energy storage, China leads the market, followed by the U.S. and Europe. The graph below illustrates country-wise energy storage capacity. In 2020, 5 GW battery storage capacity was added across the globe, which was twice the capacity in 2019. The total installed capacity of Energy Storage Systems (ESS) was 17 GW in 2020, which increased from 8 GW in 2019.

The highest increase in the GW scale was recorded across China and the U.S. China had a total energy storage capacity of 3.3 GW, whereas the U.S. had a capacity of 4.5 GW. However, the entire European continent has an energy storage of 800 GW, which is expected to increase by an additional 5.2 GW by 2027.

According to the International Energy Agency (IEA), India requires additional flexibility to address the electricity demand, as the country estimates that ESS batteries will have a cumulative demand of 183 GW hour (GWh) between 2021 and 2030. In addition, the Indian government targets achieving 450 GW of energy from wind/solar sources by 2030, which is presently around 150 GW.

In terms of policies related to energy storage, countries have their agendas. China promoted sustainability by making energy more affordable & available through The Implementation Plan for the Development of New Energy Storage Technologies,” which was jointly released by the NDRC and National Energy Administration (NEA) and called for investment into energy storage projects during the 14th Five-Year Plan.

In the U.S., Behind-the-Meter (BTM) energy storage technology has been implemented, which is a small-scale BESS connected to utility meters installed in residential, commercial, or industrial settings. Moreover, it has been one of the most popular storage technologies in the country, which led to an increase in investments in 2018.

BTMs provide savings, reduce system peaks and electricity bills, and defer upgrades to energy infrastructure in a very cost-effective way. In 2021, the U.K. proposed clean energy policies, which are energy-storage friendly, and the government confirmed that clean energy technologies, energy storage, and solar Photovoltaic (PV) technology would be exempt from business rates from 2023. In South Korea, the government aims to achieve 10% renewable electricity by 2023 and 20% by 2030 by promoting the energy storage market and creating local markets so that utility companies can grow & capitalize on efficiency and learning to drive revenue generation.

Market Overview

The global energy storage systems market demand was valued at 222.79 GW in 2022 and is expected to grow at a CAGR of 11.6% from 2023 to 2030. Growing demand for efficient and competitive energy resources can propel market growth over the coming years. Clean and renewable energy is an affordable alternative to fossil fuel-based electricity, which can reduce greenhouse gas emissions and air pollution. Based on technology, the pumped hydro technology segment dominated the market with more than 95% of the total market share in terms of storage volume in 2021. Countries such as the U.K., the U.S., as well as India are expected to register high demand for electrochemical storage. Countries in the Middle East & Africa and Central and South America are poised to drive thermal storage demand in the long run.

The energy storage authorities across the European countries have chosen battery energy storage technologies to expand the use of renewable energy sources while reducing the usage of fossil fuels. Long-term growth and survival in the energy storage systemsmarket are aided by an increase in electric vehicles in countries such as Germany and France. For investments in the automotive, energy, and biochemical industries, Central & South American countries, including Brazil, Argentina, Peru, Colombia, and Chile, all exhibit a promising future. However, Argentina is anticipated to witness a considerable slowdown in energy investment as the country emerges from its current economic recession. In addition, several countries in the Asia Pacific region are developing economies undergoing rapid industrialization.