Report Overview

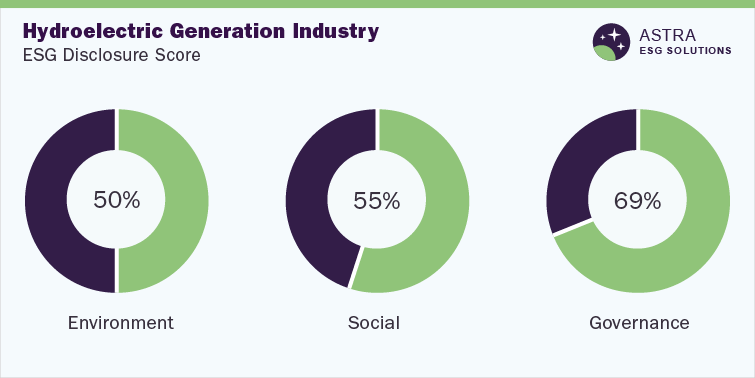

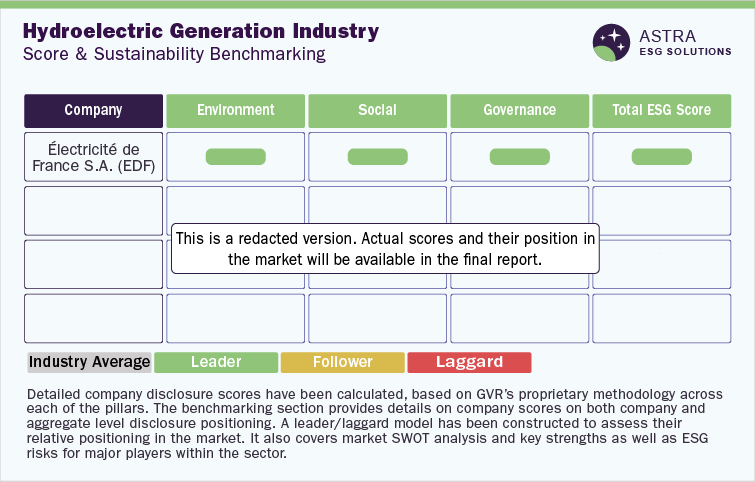

The average ESG disclosure score for the hydroelectric generation industry is estimated between 60% and 70%. This score was derived after analysis of more than 60 Environmental, Social and Governance (ESG) parameters within our ESG scoring framework. In addition to Électricité de France and Tata Power Company Limited six other market leaders were part of our research.

This research identified that only one company - Électricité de France S.A. scored above the industry average scores. In comparison, all the other leading companies were required to improve their ESG transparency and reporting, as they scored well below the ‘leader’ disclosure range according to our research. Our research found that the majority of the ESG disclosures have been made around the governance metric, with Centrais Elétricas Brasileiras S.A.-Eletrobrás being the leader in this sector when compared to other companies, such as Hydro-Québec.

Environmental Insights

The need for alternative sources of energy that are renewable and sustainable for the environment has existed for a long period. Hydroelectric generation is one of the oldest methods of generating electric power from the flowing current of water, using elevations created through dams and other civil infrastructure. Electricity produced through this method is reported to be affordable as compared to other renewable sources.

Among all the companies in the industry, around 90% of them have disclosed scope 1 and 2 emissions in their operations. In addition, more than 60% of the firms profiled in our research have aligned their disclosures with the Task Force on Climate-related Financial Disclosures (TCFD) standards. Similarly, more than 75% of them have institutionalized water management programs within their operations. Among the top three firms in the research, which include Électricité de France S.A., WEC Energy Group, Inc., and Eletrobrás, all of them have water management programs that include using water-efficient systems in power plants, conducting technical inspections to monitor water use, and making use of ‘reusable water’ for its operations.

In terms of environmental certifications, 75% of them were accredited to the ISO 14001 environmental certifications. Among the top three firms, Electricite de France (EDF) has been operating with an ISO 14001 Environmental Management System (EMS) certification. Some sites of Centrais Elétricas Brasileiras S.A.-Eletrobrás are certified by ISO 14001 EMS, whereas the WEC Energy Group has no ISO 14001-certified facilities.

Furthermore, more than 50% of the companies in this industry have a board to oversee climate risk. The board of directors of EDF considers climate change as a part of the company’s strategic planning, examining climate change periodically and addressing climate change risks & challenges in the process of making decisions.

The WEC Energy Group has made an agreement with the audit and risk committee and it has provided assurance on the proper functioning of the environmental management system and mitigating the risks associated with climate change as part of the new project.

In terms of waste management, around 60% of companies in the industry have programs to dispose of waste or recycle it efficiently in order to reduce the environmental impact of waste. The top companies in the hydroelectric generation market implement waste management strategies, such as recycling, reusing, reducing, and circular economy practices.

WEC Energy Group has implemented a waste management strategy by sending used batteries, cylinders, and chemicals back to vendors or the corporate location for reuse. The company started to neutralize hazardous chemical waste elementally through fuel blending programs for the potential reuse of natural gas pipeline liquids.

Despite the strong environmental disclosures, companies in the hydroelectric generation industry have room for improvement in reporting their renewable energy consumption and set up targets to improve renewable energy in their operations. According to our research, less than 30% of the companies in this industry have reported on renewable energy usage metrics and less than 20% disclose the amount of water reused in their operations.

The below graph compares the total emissions across the top three companies in the environmental pillar:-

Social Insights

The social component of the ESG deals with improvements in the value chain of the companies, the employee retention & turnover rate, and the method of business continuity. Around 75% of companies in the hydroelectric generation market have human rights policies integrated with their supply chain code of conduct, enabling them to comply with the policies.

Companies such as EDF, Tata Power Company Limited, and Duke Energy Corporation have mandated the integration of human rights with supplier chain codes of conduct. EDF has reported that its human rights policy is dedicated to preventing all forms of workplace harassment, sexism & violence and opposes all forms of forced labor & child labor, conforming with the International Labor Organization’s core agreements.

Tata Power Company, on the other hand, has a Responsible Supply Chain Policy that mandates members of the supply chain to adhere to this policy, which promotes human rights. At least 50% of the companies in the market are focusing on improving gender diversity in their workforce. EDF had set the 2023 goal to increase the diversity rate, increasing the percentage of women directors to 40% and women in group management committees to 28%. However, Tata Power has made a policy to increase diversity and inclusion, but no target was disclosed. An increase in diversity rate is reported to drive productivity.

More than 60% of the companies in the hydroelectric generation industry have disclosed employee turnover rates. Duke Energy has the highest employee turnover rate among the top three firms in the industry. A high turnover rate indicates the morale and performance of employees as well as decreased profits.

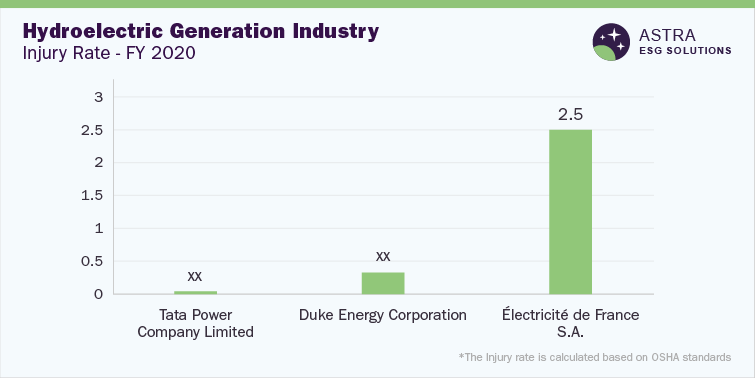

The injury rate of the companies in the market indicates the safety of the work environment. According to our research, more than 75% of the firms in the industry have disclosed the total injury rate in their operations. Among the top three firms, EDF has a higher injury rate. In contrast, Tata Power Corporation has a lower rate of implying that EDF needs to focus on improving the safety of its work environment.

Around 75% of the companies in the industry have the ISO 45001 or 18001 health and safety certification. EDF has disclosed that 63% of its operational sites are certified by safety operational systems, such as ISO 45001:2018 and OHSAS 18001. Tata Power Company Limited has reported that all operating sites have safety systems and the operational site at Mumbai has ISO 45001:2018 certification.

The below graph provides a comparison of the injury rate and the employee turnover rate across the top three firms in the social pillar:-

Governance Insights

Empirical studies suggest that ESG, especially the governance aspect, impacts financial outperformance. A wide range of metrics in the governance sphere, such as the code of business conduct, risk & crisis management, and supply chain management, have a direct impact on the overall business performance of a firm.

Hydroelectric generation Industry leaders in governance benchmarking are EDF, WEC Energy Group, and Duke Energy Corporation. Around 75% of the companies have more than 30% women on the board of directors, with Duke Energy leading the position, WEC Energy Group being the second, and Electrobrás being the last. Furthermore, the percentage of independent directors was high in Duke Energy, followed by WEC Energy Group in the fiscal year 2020.

Around 80% of the companies in the industry have cybersecurity and data protection policies (of their own). Electrobrás has its own cybersecurity and data privacy policies to combat cybersecurity threats. The company has implemented a group information security policy.

The top three companies in the hydroelectric generation industry have a code of conduct, which incorporates ethical behavior among the members of the company at all levels. Electrobrás, on its 10th anniversary, revised its code of conduct and integrity document and launched a mobile app for employees to access the code at any given time easily.

The below graph gives a comparison of the female representation on board across the top three firms in the governance pillar.

Country-level Insights

An increase in demand for renewable sources of energy is expected to drive the hydroelectric generation industry. Hydroelectric generation is reported to be a 100-year-old method of producing power, which is preferred due to the low amount of toxic waste and negative GHG emissions. Furthermore, popular as a cheap source of renewable energy, hydroelectric power serves as a solution to short-term power shortage challenges.

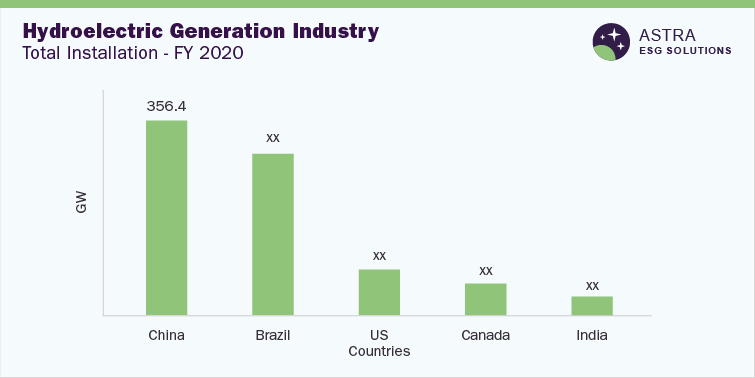

On a global scale, China is the leader in hydropower electricity due to the lower amount of fossil fuels and the preference for energy independence by the government. The second-largest manufacturing country on a global scale is Brazil, largely due to the higher precipitation and elevation with changes in water bodies & rivers.

The U.S. is the third-largest producer of hydropower electricity, with a capacity of 6.81 Gigawatt (GW) in Washington. Canada ranks fourth on the global scale, with two large production facilities-one of them producing power with a capacity of 5,616 Megawatt (MW). India, on the other hand, has announced that it will make the production of hydropower more feasible and declared that plants that produce 25 MW of power are renewable energy sources.

Market Overview

Depletion of fossil fuels, along with an increase in demand for renewable sources of energy, impacts market growth. The continuous trend for renewable sources of energy is reported to underpin hydroelectric generation over the forecast period. Production of hydroelectric power enables overcoming short-term shortage of power, simultaneously benefiting the flood & drought areas and irrigating the nearby lands.

On the basis of capacity, the industry can be classified into three types: large, medium, and small. In terms of technology, the market can be segmented into reservoir, run-over-river, and pumped storage plants. The reservoir technology has been reported to be widely used in the industry due to benefits such as irrigation facilities and managing flood & drought areas. Besides, pumped storage is used when the supply surpasses the demand by pumping the water from the lower to the upper reservoir. Hydropower finds a wide range of applications in many industries, which makes it the largest application segment, followed by residential & commercial applications.