Report Overview

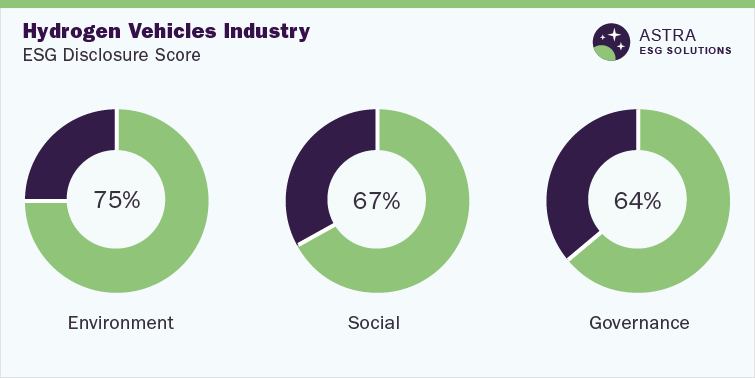

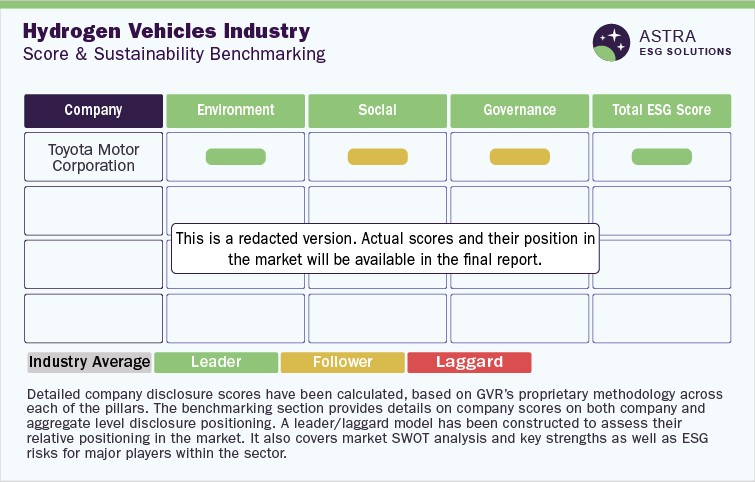

The average ESG disclosure score for the hydrogen vehicles industry stands between 60% and 70%. This conclusion is based on the analysis of more than 60 Environmental, Social, and Governance (ESG) parameters within our ESG scoring framework. Alongside Toyota Motors Corporation & General Motors, six other market leaders were part of our research. This research identified that only one company, Toyota Motors Corporation, scored above the average industry score.

In contrast, the seven other leading companies are required to improve their ESG transparency and reporting, as they scored well below 70%. Our research found that a majority of the ESG disclosures have been made around the environment metric, with Toyota Motors Corporation being a leader in this sector when compared to other companies, such as General Motors, from an overall ESG disclosure point of view.

Environmental Insights

Historically, energy supply has been dependent on fossil fuels, which leads to the exploitation and depletion of resources. However, the gradual need for supply of energy, as well as the negative impacts caused by fossil fuels, have driven the search for alternative & sustainable sources of energy on a global scale. In this scenario, hydrogen fuel cells have emerged as a front-runner with zero emissions to help achieve sustainable and environmental goals.

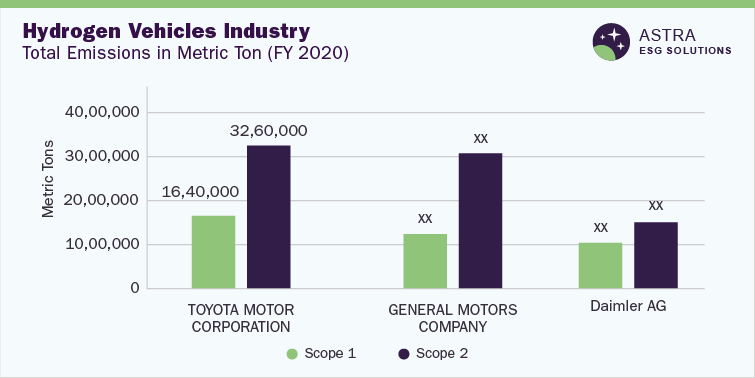

Around 90% of the companies in the hydrogen vehicles industry disclosed the climate scenario for climate change risks. The climate scenario helps the companies explore and structure the business models to guide the companies in creating a positive impact on the climate. Emissions were disclosed by all the top companies in the hydrogen vehicles market. For instance, Toyota Motors Corporation has disclosed the highest scope 1 and scope 2 emissions. Contrary to Toyota, Daimler AG reported the lowest scope 1 and scope 2 emissions, crediting the lower emissions to its continuous sustainability strategy to implement goals to minimize emissions from the plants and make many climate protection policies through science-based targets initiatives. The emission intensity of the top three companies of the market, in environmental metrics, was highest for General Motors, while the lowest was for Daimler AG.

In terms of environmental certification, only 50% of the companies profiled in our research have ISO 14001 Environmental Management Certifications across their sites. However, as of the top three firms in the environmental pillar, all the companies have disclosed environmental certifications of ISO 14001. However, only 20% of the General Motors production facilities are accredited with ISO 45001.

Around 50% of the companies in the hydrogen vehicles market have a board oversight for climate change. The board of directors of Toyota Motors supervises the operating officers so that they can direct and make decisions about climate change. The General Motors Board of Directors oversees ESG risks & assessments and makes necessary decisions to execute the strategic decisions related to ESG. In addition, the Board‘s Governance and Corporate Responsibility committee oversees the decisions of ESG, which also oversees the director’s independence and related risks as well as sustainability risks.

While all of the top three companies have made Water Management Programs in order to conserve fresh water, none of the other firms in our research have water management programs. Toyota Motors has aimed to reduce water consumption by using rainwater and recycled water for manufacturing purposes. Furthermore, by collecting data, the company aims to take significant measures by considering local demands and concerns. General Motors has committed to water conservation by taking appropriate measures to preserve and improve water quality, which uninterruptedly helps the company function during water scarcity. Daimler AG has been using closed loop cooling systems, which allow the water to be recycled. Furthermore, the company has saving fittings, which help in water conservation.

The below graph provides a comparison of the total emissions across the top three firms in the environmental pillar:-

Social Insights

The social component of ESG deals with the improvement of the value chain of the companies, the employee retention & turnover rate, and the method of business continuity. Around 90% of the companies in the hydrogen vehicles industry use safety certifications, such as OHSAS 18001, indicating that they consider employees’ safety & health. In the social metrics, the top three companies in the hydrogen vehicles market are KIA Corporation, Tata Motors, and Hyundai Motor Company. KIA Motors was the first Korean company to acquire an ISO 45001 certificate. Tata Motors Limited has robust safety systems, with each facility certified with ISO 45001. Hyundai Motor Company’s facilities are also accredited with ISO 45001.

More than 90% of the companies in the industry have human rights integrated into their supplier code of conduct. Kia Corporation has publicly disclosed its supplier code of conduct, which aligns with the human rights standards. Tata Motors has a publicly disclosed code of conduct for suppliers, which prohibits forced and child labor.

Hyundai Motors Corporation has publicly disclosed a human rights statement and strives to respect the human rights standards set on the international level by applying the principle of universal respect in all business operations and providing products & services that promote human rights. The policy applies to all the executives, employees, and third parties that deal with the company, including the supply chain.

Only around 30% of the firms have disclosed information regarding employee surveys. Kia Corporation conducts an annual cultural survey, and the company reported that the satisfaction level among its employees improved for the year 2020. However, Tata Motors Limited has not disclosed any report on the employee engagement survey. Hyundai Motors Company, however, annually conducts a cultural survey on employee engagement across the globe. In the year 2020, it conducted a survey to gain insights into the true corporate culture at an organizational level.

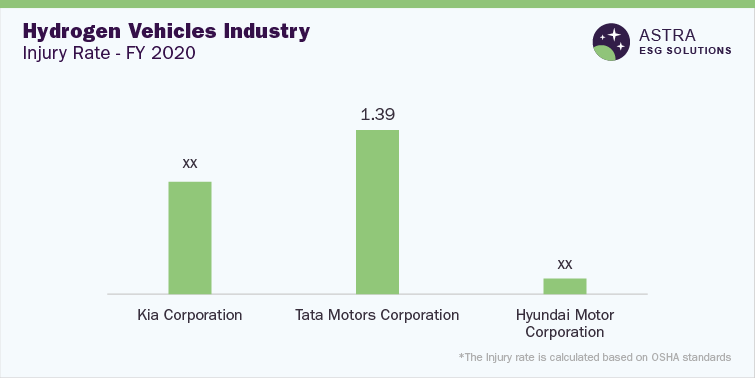

In terms of injury rate, only around 30% of the firms in the industry have made disclosures. Among the top three firms, Tata Motors Limited reported the highest Injury rate for the year 2020, while Hyundai had the lowest injury rate in its global operations. Hyundai Motor Company undertook necessary measures and made policies to improve the injury rate, such as a safety-first culture. Meanwhile the company achieved a zero injury rate in Korea from 2017 to 2020.

The below graph provides a comparison of the injury rate among the top three firms in the hydrogen vehicles industry:-

Governance Insights

The analysis of governance factors pertains to decision-making, board diversity, shareholders’ rights, anti-competitive practices, and transparency. Additionally, a wide range of metrics is included in the governance sphere, such as code of business conduct, risk & crisis management, and supply chain management.

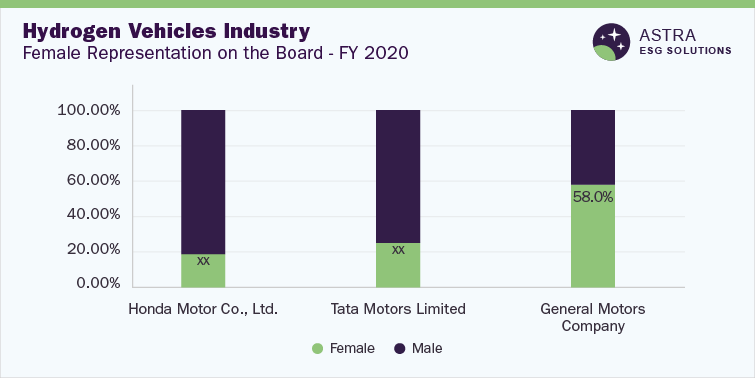

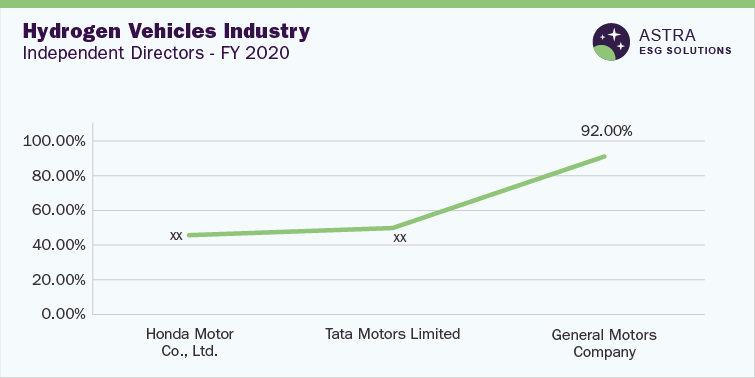

In terms of governance metrics’ disclosures, all companies in the hydrogen vehicles industry have a fair representation of independent directors on board, with an average of 50% independent directors on board across all firms. However, the number of female directors on board is less than 30% across 90% of the firms profiled in our research.

Among the top three firms, General Motors reported the highest number of female directors and independent directors on the board, indicating the company has efficiently executed the diversity policy and improved the scope for better corporate governance. However, Honda Motors Co. reported the lowest number of female directors and independent directors on the board in 2020.

In terms of cybersecurity, only 50% of firms have disclosed that they have a cybersecurity program. Among the top three firms, Honda Motors Co. has committed to protect the information of the consumers and, in this regard, the company has appointed information supervisors and information managers in departments for handling information related to the consumers. In essence, Tata Motors Limited’s cybersecurity is managed strategically with a security program and roadmap, which ensures that the data is protected and human information risks are reduced. Furthermore, by maintaining rigorous controls and managing enterprise information risks to acceptable levels, proactive cyber defenses, and supply chain security assurances, Tata Motors has a strong social disclosure.

Similar to disclosure on cybersecurity, only around 50% of the firms in the hydrogen vehicles market have disclosed that they have a code of conduct in place. Honda Motor Co. has a publicly disclosed code of conduct document that applies to the members and subsidiaries, and it has a whistleblower program. Meanwhile, Tata Motors has a separate code of conduct for the employees and is focused on maintaining transparency among the people associated with the organization. General Motors Limited has a detailed code of conduct that deals with the subsidiaries, employees, and all third parties & trains employees in ethics policies.

The below graphs represent the number of women directors and independent directors on board across the top three firms in the governance disclosure.

Country-level Insights

At an international level, Japan is the leader in Asia, with around 50% of the hydrogen fuel cell charging stations and advanced HFCV infrastructure, which can steer the development of the HFCVs in the country. As of 2021, two leading companies in the country produced HFCVs commercially, which include Toyota and Honda.

Japan has advanced technology with a wide range of applications, such as power generation, fueling passenger cars, steelmaking, and fueling ships. The Asian giant aims to achieve carbon neutrality by 2050 and have around 200,000 FCVs on the road by 2025.

China is the largest producer of hydrogen at the global level, with 33 million tons of hydrogen, which mainly comes from fossil fuels. The country has 105 hydrogen fuel cell stations and ranks next to Japan. As of 2020, the country had 8,000 HFCVs on the road and plans to have around 50,000 vehicles at the end of 2025. The largest manufacturer of pick-up trucks and Sports Utility Vehicles (SUVs) in the country-Great Wall Motors-aims to become a top HFCV powertrain producer by 2025 by expanding production and sales of components of HFCVs in China.

Germany is well-known in the hydrogen fuel cell market with companies such as Audi & BMW, which have planned to deploy HFCVs to help meet the country’s climate targets and reduce dependence on fossil fuels. The German government is focused on supplying hydrogen to automotive, steel, & chemical industries to help achieve climate targets. To illustrate, BMW has aimed to accomplish mass production of SUVs by 2030.

Korea is considered the most innovative country and hydrogen mobility plays a crucial role in this aspect. The country has aimed to achieve a net-zero target by 2050. As of 2021, Korea has a fleet of 18,000 HFCVs, including heavy-duty vehicles, and it intends to expand the number to 35,000 in the near future. Air Liquide is supporting several hydrogen projects that are currently underway under the South Korean government.

The U.S. is not left behind as the U.S. Department of Energy (DOE) aims to increase the dependence on renewable sources of energy and is making rapid progress by creating hydrogen fuel outlets for this purpose. California is considered to be home to most of the FCVs in the U.S. Presently, there are 10,665 HFCVs on the road.

However, as of now, there are no HFCVs in India, which can be attributed to a lack of infrastructure support and the production of hydrogen. NITI Aayog-Government of India’s National Institution for Transforming India, which is a policy think tank in the country-estimates that India can reduce 3.6 gigatons of CO2 by 2050 by adopting green hydrogen solutions. However, in the near future, the country is aiming at improving hydrogen extraction infrastructure rather than facilities.

Market Overview

The global fuel cell vehicle market size stood at USD 1.45 billion in 2022 and it is poised to expand at a CAGR of 52.5% between 2023 and 2030. The increasing need for alternative, renewable, sustainable energy due to the depletion of fossil fuels is one of the driving factors of the market, which also impels the development of green and carbon-free sustainable fuel.

The transition from fossil fuel vehicles to eco-friendly vehicles has positively impacted the market. The market is reported to be in the early stages of development, as some companies based out of Japan, such as Toyota and Honda, have launched FCVs; however, the Germany-based BMW AG and AUDI are still working on the prototypes. Renault has made a prototype FCV named Scenic Vision, which is equipped with a 16kW fuel cell to give it a range of 800 kilometers without the need to charge. It has been reported that the battery will be lightweight and the carbon footprint will decrease by 75%.

There are passenger cars, HCVs, & LCVs in the market, and passenger cars are reported to be dominant. The surge in demand for passenger cars in countries like Japan and South Korea could be an underlying factor that drives the market. However, fuel cells are expected to be expensive, limiting the market to only a group of consumers.