Industry Sustainability Outlook

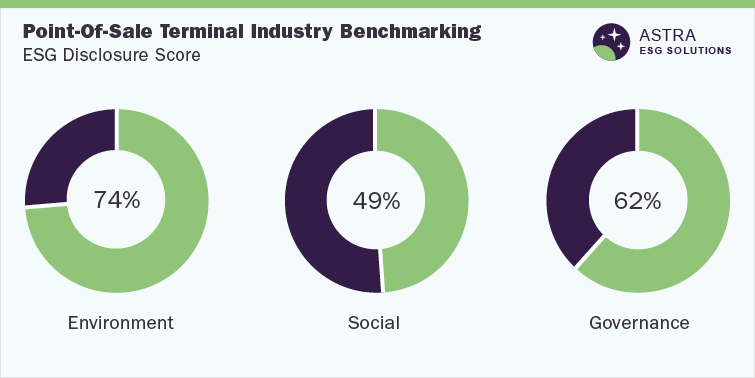

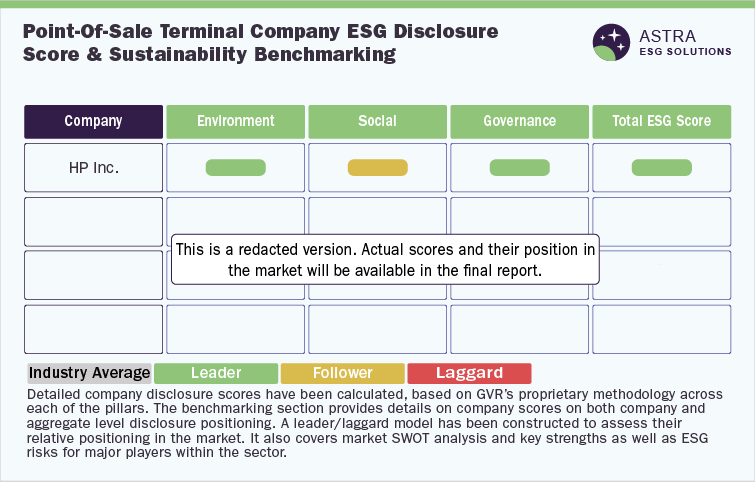

The average ESG disclosure score for the point-of-sale terminal Industry is between 60% and 70%. Our proprietary Environment, Social, and Corporate Governance (ESG) scoring framework analyzed 65 parameters across ESG, as represented in the methodology section of this document. Hewlett Packard Inc., Toshiba Corporation, Panasonic Corporation, and seven more market leaders were part of our research. Six out of 10 companies we researched scored above the average industry score. However, three market leaders need to focus more on ESG reporting and transparency, as they scored well below 50%.

Nonetheless, we have seen a positive pattern in ESG revelation among point-of-sale terminal industry participants since 5 years. Our research shows that most of the sustainability-related revelations have been made around ecological measurements, which stand at almost 75%, followed by governance and social with a score of ∼ 60% and ∼ 50%, respectively. Hewlett-Packard, Inc. (HP) has been a leader in the sector from an ESG disclosure standpoint with a score of 79% followed by Toshiba Corporation and Panasonic Corporation, among others.

Environmental Assessment

During the COVID-19 pandemic, the global transition from the coin- and paper-based payments to digital transactions implies that the quantity of Point-of-Sale (POS) terminals is rapidly growing. However, this development is accompanied by liability; not exclusively to consider the effect the increased number of gadgets has on various factors like financial incorporation, additionally with the ecological impact of the assembling process of payment terminals, their transportation, use, support, and end-of-life handling. Some of the significant sustainability challenges faced by the industry are generation & disposal of e-waste during the end-of-life of POS equipment; large-scale use of paper in the form of printed receipts, resulting in waste generation; and the supply chain disruptions arising from semiconductor shortages, which have led to the adoption of various methods such as reducing top margin, on-demand printing, receipt compression, and greener manufacturing, such as halogen-free cases & recyclable packaging.

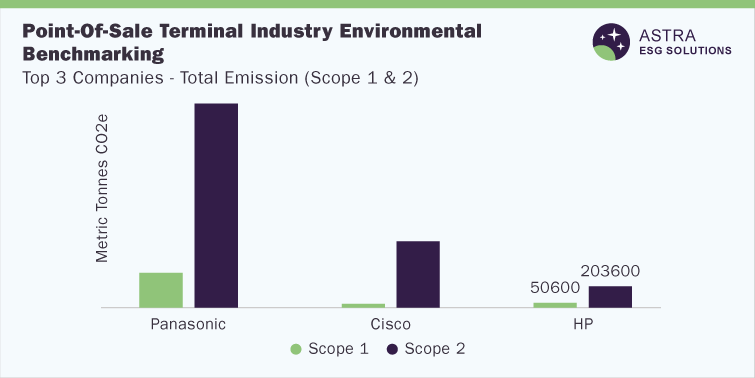

Players in the POS terminal industry are continuously attempting to increase the number of produced units and strengthen their presence across the globe by adopting eco-friendly operations and defining relevant targets to track their progress. For instance, Panasonic Corporation has aligned to the Green Plan 2021 to mitigate both product and production activities through evaluation of water risks across all regions. Moreover, the company has also reduced the emission of waste by boosting yield in its production process and by increasing the recycling rate of waste materials by strictly adhering to Waste Sorting Practices in the production processes.

One of the major players in the POS terminal market, HP, has ensured that overall sustainability performance is under the supervision of its chief sustainability & social impact officer along with the VP & head of sustainable impact operations. The company has also targeted to reach Zero waste in operations by 2025 and had reported the lowest rate of emission &energy consumption for 2020. Furthermore, the ISO 14001 accreditation plays a significant part in guaranteeing appropriate ecological cycles/frameworks across different locales of companies. Our research revealed that all facilities of Panasonic Corporation have ISO 14001 certification, while Cisco Systems Inc. has only 31 sites that are certified with a total of 21 ISO certified facilities under HP.

Provided below is an example of major organizations under the environmental benchmarking concerning their scope 1 and scope 2 emissions:

Social Assessment

Predominantly, social metrics consist of an assessment that covers both the parameters–human capital and community. The variables that are accounted for in this classification are employee turnover rate as well as their wellbeing & security, including injury rates, and OHSAS certificates, alongside government assistance provided to both workers & clients. Among the companies within the sector, Toshiba Corporation ranks highest on the social pillars with a score of around 90%. It has standardized robust human rights checking components not only within its own operations but also across the supply chain. It also considers the health and safety of its employees as a priority factor. Therefore, in 2020, Toshiba acquired ISO 45001certificationsfor 100% manufacturing sites. A vast majority of organizations have conducted customer satisfaction studies, however, only a few have revealed the quantitative outcomes, which is surely an area of improvement.

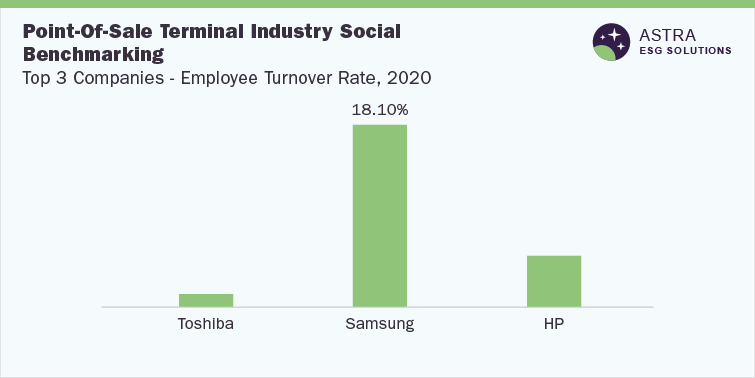

Moreover, Samsung Electronics is an exception, which has one of the highest employee turnover rates (18.10%) despite having comprehensive healthcare plans for employees. The firm also provides robust H&S training and health insurance to its employees with many training programs, such as leadership training, to strengthen specialization at work, which resulted in the lowest injury rate among its peers. Furthermore, it also helps employees with external training opportunities such as MBA, academic training, job expert courses, regional expert classes, and AI expert courses.

Provided below is an assessment of a few of the major organizations within the sector with regard to employee turnover rate:

Governance Assessment

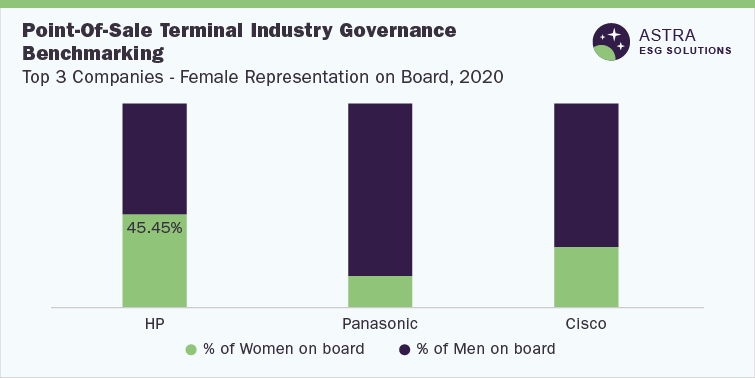

The Governance aspect within ESG evaluation is one of the principal foundation stones of an association, which integrates various estimations, including business ethics, board structure, monetary issues, payoff, succession planning, and statutory audits, among others. As per Grand View Research’s ESG scoring model, HP ranks the highest in corporate governance among its peers operating in the point-of-sale terminal market. The organization has the highest number of independent directors (more than 91% of the board includes autonomous chiefs or independent directors), which enhances corporate responsibility and administrative principles in accordance with investors and consumers. HP has a designated Chief Information Security Officer (CISO) who monitors privacy-related issues. It also has the highest percentage of female members on its board, which is above 45%. This depicts a positive diversity initiative, and the incorporation of planned annual incentives for its top executives, linked to the sustainability performance, helps boost accountability for sustainability performance. Due to the institutionalization of a robust business continuity plan consisting of emergency responses along with disaster prevention & mitigation responses, Panasonic Corporation ranked second in the governance metrics. In addition, the company has established systems related to compliance issues for reporting & whistleblowing and investigation & correction of violations. With an increase in the number of cyberattacks, various organizations have adopted different plans such as Cisco Systems, Inc. has a centralized chief privacy office with regional officers leading each of the three major regions, including Americas, EMEA, and the Asia Pacific, which includes Japan & China. Each regional officer chairs a regional privacy council for their respective territory.

Provided below is a comparison of the top three companies under the governance benchmarking with regard to female representation on board:

Country ESG Outlook

Despite the surge in demand for POS terminals globally, there have been some disadvantages associated with the generation & disposal of e-waste during the end-of-life of POS equipment, customer data privacy & security, and supply chain disruption, among others. Therefore, to combat these challenges, most legislation and policies as of now allude to the standard of "Extend Producer Responsibility” that expects makers to acknowledge liability regarding all stages in an item's lifecycle, including its final disposal.

Under the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and their Disposal, in 2021, Environmental Protection Administration Taiwan (EPA) and U.S. EPA enrolled for the assistance of Sustainable Electronics Recycling International (SERI) to reuse, repair, and recycle gadgets.

We have also seen that many organizations are participating in various business deals, including associations, consolidations, acquisitions, and geological extensions, to remain relevant in the market. For example, in September 2021, Elo Touch Solutions, Inc. collaborated with CERTIFY Health to offer a patient self-administration arrangement. This organization coordinated Elo's all-in-one touchscreen PCs alongside a cloud-based interface, medical services suppliers, and foundations by CERTIFY Care, which can enhance patient enlisting work processes. Along with developing the organization's size and reach, market players additionally focus on innovative work to make items with furthest down-the-line advancements contend in the market.

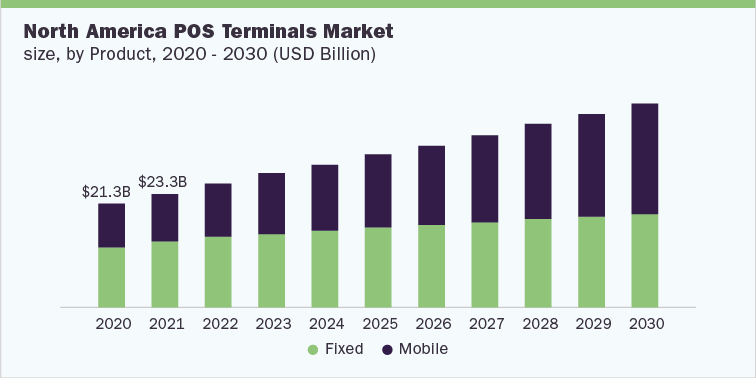

POS Terminal Market Overview

The POS terminals market size at a global level was valued at USD 85.16 billion in 2021 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% from 2022 to 2030. The increasing demand for cashless payments has enhanced interest for POS terminals. POS frameworks use remote gadgets to work with retail shops, healthcare, and various industries that are adopting digital payments, leading to innovations that facilitate different sectors, from rental taxis to eateries. The Asia Pacific is projected to emerge as the quickest-developing local market with North America as the second-biggest provincial market with an improvement rate of more than 5.0% for the given forecast period. Global demand for POS terminals is increasing, with a projection of revenue of around USD 181.47 billion by the end of 2023. Significant investments are being made to support sustainability, and our research reveals that most of the organizations in this space have been detailing their ESG-related initiatives, projects, targets, and plans, to enhance transparency.