Report Overview

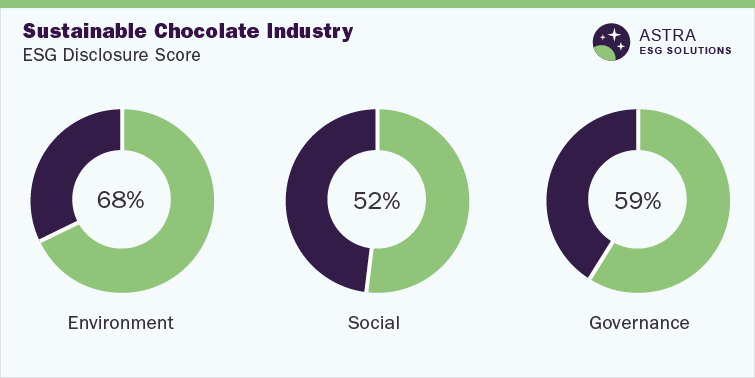

The average ESG disclosure score for the sustainable chocolate industry is between 55% and 65%. Our proprietary ESG scoring framework analyzed 65 parameters across the environment, social, and governance pillars. Nestlé S.A., The Kraft Heinz Company, and six more industry leaders were part of our research. Two out of eight companies researched in our study scored well above the average industry score. However, our research identified three companies as laggards that would need to focus on improving their overall ESG scores and overcoming the lack of transparency around ESG disclosures.

There is significant room for improvement for major players in the sustainable chocolate industry in terms of social performance, specifically in improving occupational health and safety. Our research confirms that the majority of sustainability-related disclosures have been made around governance and environment metrics followed by social metrics where from an ESG performance perspective, Nestlé S.A. is the leader in this sector, followed by Meiji Holdings Co., Ltd and the Kraft Heinz Company, among others.

Environmental Insights

The growing concerns over the environmental and social impacts associated with the chocolate industry have triggered the popularity of sustainable chocolate. The production and consumption of chocolate have numerous impacts in terms of ESG. Producers are struggling to cater to the increasing demand for chocolate worldwide, which can particularly lead to complex effects on the environment, farmers, and other stakeholders involved in the overall process.

Greenhouse gas (GHG) emissions associated with the chocolate industry originate from a variety of activities, including agriculture, manufacturing, packaging, land use change, and transportation. Estimates suggest that an average of 1 kilogram of chocolate is responsible for 5 kilograms of carbon emissions. Overall, the chocolate industry is responsible for a significant portion of GHG emissions associated with the food & agriculture industry. However, leading companies are making several efforts to reduce GHG emissions associated with the chocolate industry.

Companies in the sustainable chocolate industry have made disclosures on their GHG emissions which allows investors to make an estimate of environmental risks associated with the growth of the business. As per our research, three companies have achieved a leader status on the environmental disclosure scoreboard, including Nestlé S.A., Meiji Holdings Co., Ltd, and Mondelez International. Out of the three leaders, the highest scope 1 and scope 2 GHG emissions were found to be associated with Nestlé S.A. (in 2021) and the lowest reported were by Meiji Holdings Co. Meanwhile, the highest emission intensity was found to be linked with Meiji Holdings, while Mondelez reported the lowest.

Efforts taken toward climate change stand as a strength in the sustainable chocolate industry, as four out of eight companies have disclosed their scenario analysis in compliance with the Paris Agreement. This strengthens the preference of the investors for the industry as the analysis allows the investors to take informed decisions. However, even though all eight players have waste reduction plans in place, only four companies were able to disclose the recycling percentage. Therefore, according to our research, waste recycling provides a large scope of improvement in the industry.

All eight companies we analyzed in the sustainable chocolate industry have revealed their water management programs and futuristic goals to further their steps in instilling sustainable business practices. For instance, Meiji Holdings Co. has disclosed a definite goal for reducing the water consumption volume by 2050. Additionally, two out of three leaders on the environmental matrix have achieved ISO 14001-certification accreditation, which depicts better resource management and sustainable business practices. Environmental expenditure disclosure and local sourcing are other significant areas that can help businesses in the sustainable chocolate industry to grow sustainably, as the companies profiled in the industry have not disclosed regarding the same.

With respect to environmental benchmarking, the following chart compares the Scope 1 and Scope 2 emissions along with the emission intensity of the top three companies in this category: -

Social Insights

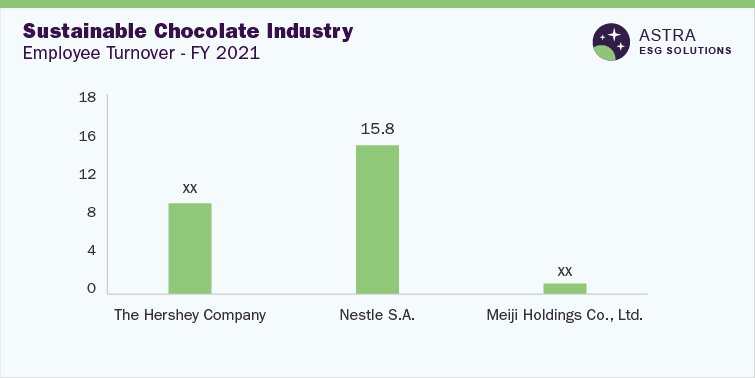

Social metric assesses the risk to and opportunity for a company from community and human capital (which includes employees and stakeholders) and their relationship with them. Employees’ and Safety parameters covering OHSAS certifications and injury rates, alongside employee training and development, employee engagement programs, and human rights, are majorly included in this category. Out of the eight companies profiled in our research, the highest company level disclosure stands at 67%, which depicts the scope of improvement in the industry.

All eight companies, including the top three, have shown their emphasis on career development and upskilling of employees in their disclosures, which enhances business productivity and adds to the overall value of the business in the industry. Research also suggests that all the leading entities are committed to ensuring a safe and inclusive working environment by implementing human rights policies across all the supply chains and supplier codes of conduct.

There stands an opportunity to achieve higher disclosure levels in the social aspect of the industry on KPIs such as average training hours and injury rates. However, in terms of business practices, the industry still falls behind in customer satisfaction and employee satisfaction surveys, which help businesses gain competent customer and employee engagement levels in the industry. No company in the sustainable chocolate market has made disclosures regarding the above two KPIs.

Under social benchmarking, the following chart provides a brief comparison of the employee turnover among the top three companies in this category:-

Governance Insights

Corporate governance practices are core to an organization, as understanding opportunities and risks in governance is critical for decision-making. Governance is one of ESG’s core components and assesses the purpose of a corporation, the role of directors, the make-up of directors, gender diversity, equity, and compensation of boards. The leading entity in the industry has disclosure scores around 80% on our disclosure scoreboard, whereas the company with the lowest disclosure had a disclosure score below 30%.

Implementation of the Code of Conduct is taken seriously in the industry as all eight leaders have disclosed their Code of Conduct, which maintains company compliances and ethics by instilling safety policies such as anti-bribery policies, insider training, and conflict of interest. Similarly, 90% of the companies profiled in this industry have a term limit for directors, which showcases their commitment to upholding strong corporate governance.

Furthermore, having a dedicated committee to manage climate change-related risks is understood as one of the best practices in governance. In this regard, more than 60% of the companies profiled in our research ensure board oversight of climate-related risks and opportunities.

Despite the strong performance across a few governance indicators, companies in the sustainable chocolate industry have significant scope for improvement in disclosures around their board succession planning and supplier audits. Less than 50% of the companies analyzed in our research have disclosures regarding the above metrics.

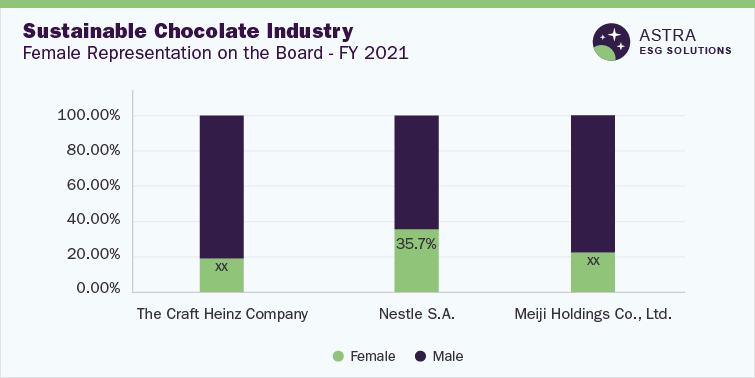

The boards across these companies are lacking in terms of female representation, as only three companies have more than 30% of women represented across their boards. Research suggests that a lack of diversity on board may prevent effective decision-making on key sustainability issues such as environmental performance.

With respect to governance benchmarking, the following chart provides a brief comparison regarding female representation on board among three companies: -

Country-level Insights

On a global scale, the top countries in the sustainable chocolate industry are all from Europe. Germany was the largest exporter of chocolate and other cocoa-related products, with value exports reaching USD 5.52 billion as of 2021. Germany is home to manufacturing sites of some of the world’s largest chocolate companies, such as Lindt & Sprüngli and Ferrero, which have a global reach and sell their products in many countries globally. Belgium followed Germany with value exports of chocolate close to USD 3.24 billion in 2021. Belgium exports most of its chocolate to the U.S. and France,and like Germany, it houses several large chocolate companies, including Godiva and Guylian.

In terms of cocoa exports, Ivory Coast (Côte d'Ivoire), Ghana, Indonesia, Nigeria, and Ecuador were the largest producers of cocoa beans as of 2021.Côte d'Ivoire, located in West Africa, led the pack with an annual production of 2.2 million tons in 2021 and accounted for 38% of the total cocoa bean production in the world. Ghana is the second-highest producer of cocoa beans globally, with production reaching 1 million tons in 2020-21. Ghana had increased the cultivation of cocoa crops by 20% in 2022 compared to 2021.

Market Overview

According to Grand View Research, the global chocolate market had a revenue of USD 113.16 billion in 2021 and is forecast to expand with a compound annual growth rate (CAGR) of 3.7% from 2022 to 2030. This can be attributed to the rise in the preference for high-quality chocolate among consumers. In addition, marketing strategies, such as attractive packaging, eco-friendly packaging, creative branding activities and promotional events, have fueled the product demand.

Product-wise, the traditional segment had more demand in the sustainable chocolate market in terms of the milk chocolate segment. The traditional segment is also in high demand due to the popularity of cocoa. The importance of ethical and sustainable sourcing of chocolate, a vital aspect of sustainability in the chocolate industry, has continued to grow among makers and consumers. In 2022, the world’s largest chocolate manufacturer, Mondelez, pledged to spend around USD 600 million by 2030 to ensure sustainable sourcing of cocoa by eradicating deforestation and child labor in its supply chain.

Apart from this, the industry is attracting demand due to the call for healthier chocolate options, which is evident by the rising footprint of dark chocolates. According to the MD of India’s leading chocolate maker, Amul, increasing awareness of the potential health benefits of dark chocolate has fueled the product demand across the Indian chocolate market. Overall, the demand for sustainable chocolate is expected to gain traction alongside consumer desire for innovation in flavors and premium chocolates.