Report Overview

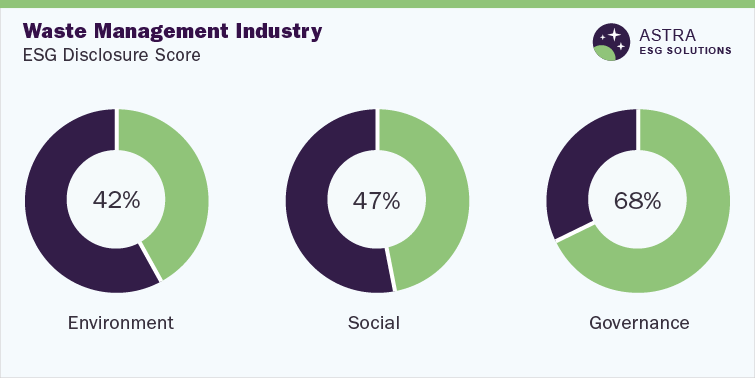

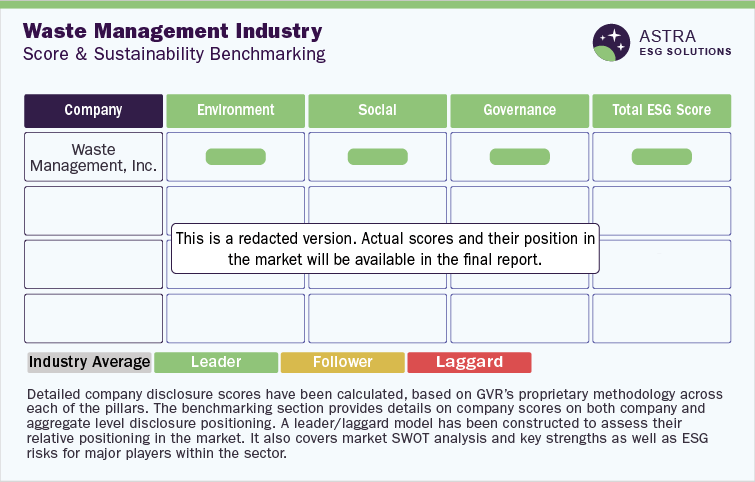

The average ESG disclosure score for the waste management industry stands between 50% and 60%. This conclusion is based on an analysis of more than 60 Environmental, Social, and Governance (ESG) parameters within our ESG scoring framework. Alongside Waste Management Inc., Cleanaway Waste Management Limited and seven other market leaders were part of our research.

This research identified that only two companies, Waste Management Inc., and Cleanaway Waste Management Limited scored above the average industry score, while the seven other leading companies were required to improve their ESG transparency & reporting as they scored well below the average ‘leader’ disclosure range accoridng to our research.

Our research found that the majority of the ESG disclosures have been made around the governance metric, with Stericycle Inc. being a leader in this sector in the governance pillar when compared to other companies, such as Waste Management Inc.

Environmental Insights

Waste management is a process of managing waste, which includes collection, processing, treating, and recycling, and it includes animal & industrial waste. The process of waste management includes different steps and the scale of management depends on economic and population activity. The hazardous impact of waste on the environment is driving the market, which evolved to develop into the concept of “waste management.”

A wide range of waste management methods is used in the market, such as landfilling, biological reprocessing, incineration, & animal feeding. It depends on the type of waste being handled, including hazardous & nonhazardous, agricultural, human-made, animal, medical, waste generated from fossil fuels, and radioactive waste.

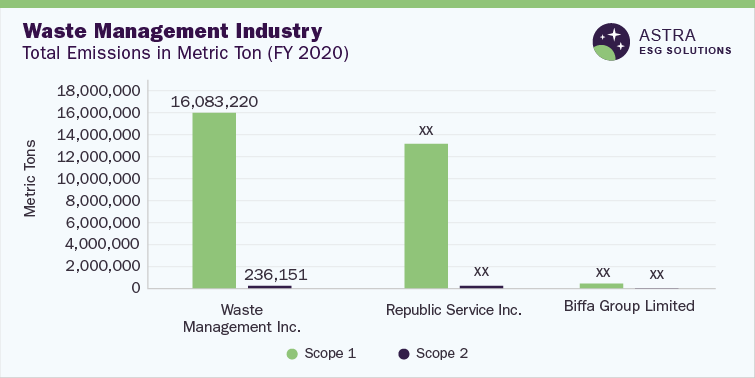

All the companies in the waste management industry have disclosed their scope 1 and 2 emissions and are focused on tracking and reporting on emissions. In the environmental sphere, out of the top three companies-Waste Management Inc., Republic Services Inc., and Biffa Group Limited. Waste Management Inc. reported the highest scope 1 emission for the year 2020, whereas Biffa Group reported the lowest scope 1 emission. In order to further reduce the emissions, the company has set carbon footprint reduction targets for the years 2030 and 2050, reducing 17% of emissions in 2020 itself.

More than 60% of the companies in the waste management industry have taken a top-down approach to climate risk disclosure, which a board member ultimately supervises. Waste Management Inc. has reported that the board of directors and senior team members oversee the climate risks and opportunities. Some companies have a sustainability and corporate social responsibility committee to advise the board to consider the objectives, policies, & strategies for sustainability opportunities and risks, which include climate risk.

Around 50% of the companies in the waste management industry have reported having ISO 14001 certification for environmental management systems, which indicates the effective utilization of resources. However, one of the top companies in the market, Waste Management Inc., has not reported on evidence related to ISO 14001 certification. At the same time, selected sites of Republic Services Inc. are certified with ISO 14001.

With respect to environmental benchmarking, the below graph compares the total emissions across the top three firms in the environmental pillar.

Social Insights

The social component of ESG deals with the improvement of the value chain of companies, employee retention & turnover rate, and the method of business continuity. Around 70% of the companies in the waste management industry have disclosed human rights policies integrated into their supplier chain code of conduct.

Cleanaway Waste Management, one of the top companies, has a publicly disclosed document of supplier policy to ensure that all the work done by the suppliers is in accordance with human rights standards. Other leading companies either have a publicly disclosed supplier code of conduct through which it strives to maintain human rights standards with suppliers, partners, and communities or have a human rights statement that mandates the third parties, including the supply chain members, to adhere to human rights standards.

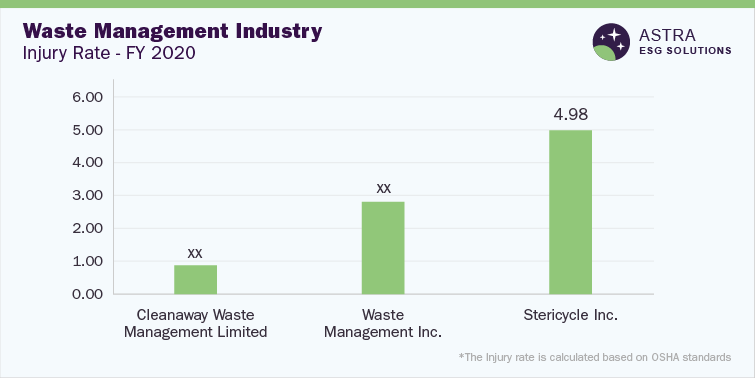

In terms of safety, all companies in the industry provide employee health benefits-more than 50% of them have a health and safety certification such as the ISO 18001 or 45001 safety certification. In addition, more than 60% of the firms in the industry have disclosed the injury rate in their operations. Stericycle, although accredited with ISO 45001, reported the highest percentage of injury rate. In contrast, Cleanaway Waste Management reported the lowest rate for the year 2020 with Occupational Health and Safety Assessment Series (OHSAS) 18001. Waste Management Inc. has not disclosed anything with regard to safety certification.

In terms of the employee turnover rate, more than 60% of the firms profiled in the waste management industry have disclosed the employee turnover rate. The employee turnover rate of Waste Management Inc. was high, while Cleanaway reported a lower turnover. Employee turnover rate suggests employee satisfaction and retention, indicating that Cleanaway has taken necessary measures for managing human capital and employee satisfaction by providing career development opportunities and work-life balance.

Companies in the waste management industry have opportunities to improve their disclosures around the gender pay gap and local sourcing. Only around 20% of the companies have disclosed the gender pay gap in their operations and explicitly mention local sourcing. Reducing the gender pay gaps means a reduction in the disparity of payment between men and women.

With respect to social benchmarking, the below graph compares the injury rate among the top three firms in the social pillar:-

Governance Insights

Investors and other stakeholders should expect the “G” from ESG to continue to evolve to reflect shifting attitudes (with an emphasis on companies’ efforts to combat environmental and social issues). A wide range of metrics is included in the governance sphere, such as code of business conduct, risk and crisis management, and supply chain management.

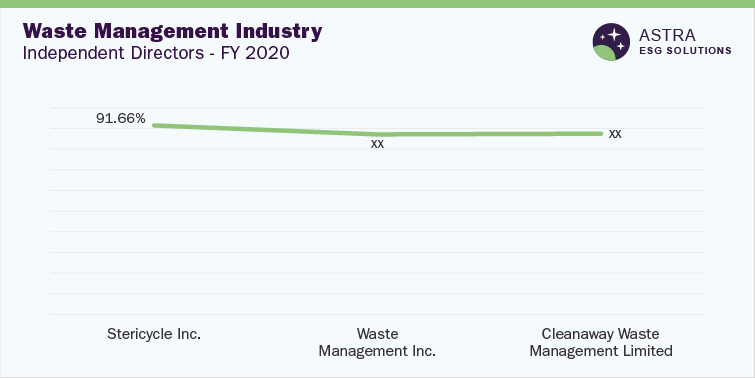

Appointing independent directors on board helps firms maintain integrity, ethics, and good governance across their operations. Among all the companies profiled in our research in the waste management industry, each of them has an independent director on board. However, not every company has an independent director as a chairman. In addition, 90% of the firms profiled in our research have established a code of conduct for employees. Similarly, around 90% of them have implemented a clawback policy.

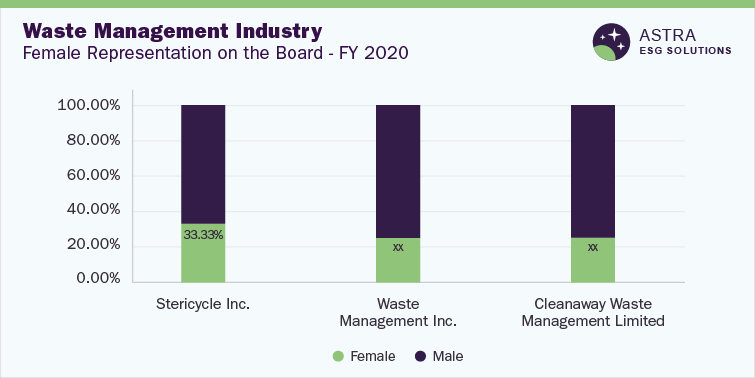

Waste Management Inc., Cleanaway Waste Management Limited, and Stericycle lead the governance pillar. Stericycle has a higher number of independent directors than the other top companies, such as Waste Management Inc. and Cleanaway Management, which have reported a lower number of independent directors. Similarly, Stericycle has reported a higher percentage of female directors as a part of the board of directors compared to the other top companies in the industry, showing that Stericycle has implemented better efforts than other companies in terms of ensuring board sustainability. However, considering all the firms in the industry, more than 60% of them have less than 30% female representation on the board.

In terms of cybersecurity, more than 60% of the firms have appointed an executive to oversee cybersecurity initiatives at the firm. However, considering the top three firms in the governance pillar, Stericycle has not reported any information regarding the policies or the strategies of the company. In contrast, Waste Management Inc. has reported that it has cybersecurity systems benchmarked against the National Institute of Standards and Technology.

More than 80% of the companies in the waste management industry have robust codes of conduct. Stericycle has a publicly disclosed code of business conduct and ethics that guides the team members while providing compliance training to its employees. Moreover, Waste Management also has a separate code of conduct that guides the company. This document highlights the management principles and smooth, transparent operation procedures for the organization, which are applicable to all employees and directors. The quality of the code of conduct directs a company’s success.

With respect to the governance benchmarking, the below graphs provide a comparison of the female representation across the boards and independent directors across the boards of the top three firms in this category.

Country-level Insights

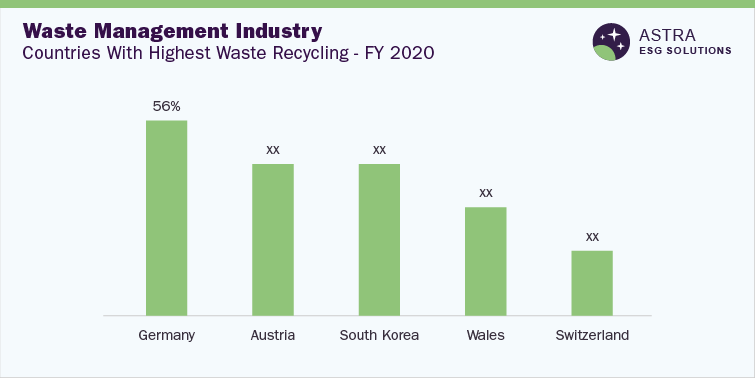

At an International level, Turkey, Latvia, and New Zealand are identified as the top three countries with inefficient waste management. However, in terms of waste recycling, Germany tops as the champion. In 1990, a packaging audit was performed by Swedish academic Thomas Lindhqvist, who developed the idea of holding producers of waste responsible for managing waste.

In order to manage waste, the audit held the waste producers responsible for the packaging waste they produce. This led to the development of the Extended Producer Responsibility (EPR) model, which focuses on redirecting waste headed to landfills to be recovered, reused or recycled. Furthermore, Germany has developed a dual recycling system by collaborating with “the Green Dot” to collect waste from households and businesses. In 2019, the “Germany Packaging Act” was introduced, which helped Germany maintain a waste rate of up to 56% since 2016.

Austria holds the second position in terms of waste recycling. It has implemented a model similar to Germany. Altstoff Recycling Austria (ARA) was established in 1990 and is one of the nonprofit companies that has been implementing the EPR model. The country has banned the import and export of some plastics, further reducing waste and helping it maintain a waste rate of 53%.

As of 2022, South Korea managed to recycle or regenerate around 50% to 60% of its waste, ranking first among 36 countries by scoring 100, according to Sensoneo’s Global Waste Index 2022. The environmental ministry of South Korea has made a policy to reduce the import of waste paper to reduce waste.

Wales, despite being a small country, has managed to record a 52% rate of waste recycling every year. The country’s policymakers have integrated sustainable development into statutory duty. As of 2022, the country made a policy to ban single-use plastics and executed a circular economy strategy to manage waste effectively.

However, in the case of India, it has been estimated that around 88 square kilometers of land will be required to manage waste. One of the greatest challenges in waste management for India is solid waste management, as landfills in the country have overflown. Furthermore, the country lacks scientific landfills to control the emission of methane from waste landfills, burning of which could be a major threat to the environment.

Market Overview

The waste management market at a global scale was valued at USD 989.20 billion as of 2021 and is expected to grow at a CAGR of 6.2% from 2022 to 2030. The underlying driving forces of the market are rigorous regulations, including the Resource Conservation and Recovery Act and the Water Shipment Regulation Act.

The pandemic impacted the market to an extent where commercial- and industrial-scale waste decreased and waste from households increased. However, post-pandemic, waste from the industries gradually began increasing due to the resumption of activities. There are different approaches to managing waste, such as recycling, incineration, composting, landfills, and open dumping.

There are some beneficial aspects of waste management, such as the usage of incineration produces heat, which can be used as an alternative source of energy. Furthermore, the method is reported to reduce the dependence on landfills for waste management and minimize waste management by up to 95%.

The need to recycle waste generated from different sectors, such as medical waste, e-waste, fossil fuels, household waste, & radioactive waste generated from urban living and industrial areas, is a key factor that drives the market. It has been reported that by 2050, around 7 billion people will live in urban areas, which will further increase the waste, challenging the market.