Report Overview

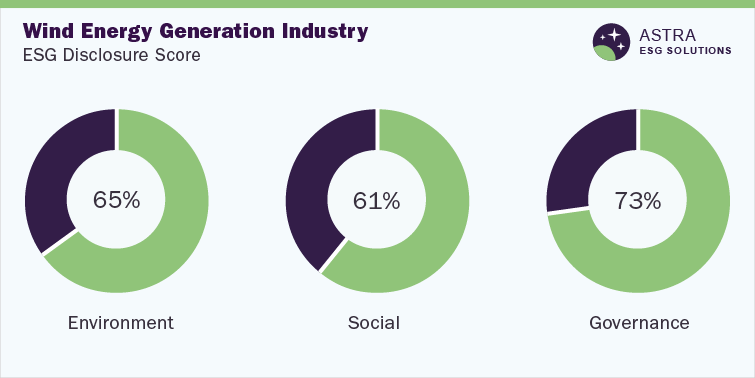

On the basis of GVR’s proprietary scoring framework, the average ESG disclosure score for the wind energy generation industry is well above 65%. This disclosure score is derived after an extensive analysis of 65 parameters across the Environmental, Social, and Governance (ESG) metrics, which has been further detailed in the methodology section of this report.

The report features eight companies, including market leaders Siemens Gamesa Renewable Energy S.A. and Iberdrola S.A. Our research found that four companies-Iberdrola S.A., Enel S.p.A., Siemens Gamesa Renewable Energy S.A., and Vestas Wind Systems A/S-scored above the average industry disclosure score. In contrast, three other companies in this industry have room to improve their transparency toward ESG disclosure, as they scored below 60% in the overall ESG disclosure score.

Overall, more than 50% of the players in wind energy generation industry have made the majority of their sustainability disclosures around the governance metric and the least is toward the social metric. Our research identifies major improvement opportunities for companies in this sector to increase transparency around social metrics.

Environmental Insights

As a form of solar energy, wind power generates lower CO2 emissions for a single kilowatt of generated electricity. The amortization of the lifespan of a wind turbine over the carbon cost shows that the carbon footprint of wind power is 99% lower than power plants that run on coal. Furthermore, wind power has a lower carbon footprint compared to both solar power and natural gas.

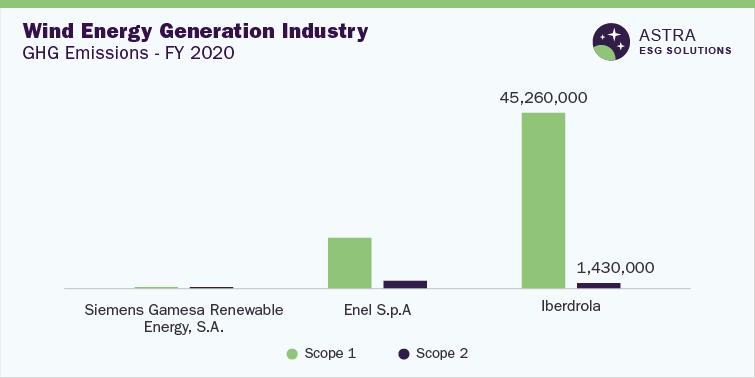

ESG disclosure of companies in the wind energy generation sector highlights their emphasis on preventing climate change and enhancing environmental protection by tracking and reducing CO2 emissions. All the companies part of our research have disclosed their scope 1 & 2 Greenhouse Gas (GHG) emissions. More than 80% of the companies profiled in our research in the wind energy generation industry have board oversight of and report on climate-related risks to the business. Siemens Gamesa Renewable Energy S.A., with an environmental disclosure score well above 80%, ranks highest among other industry players in environmental disclosure. However, the company lacks disclosure regarding board oversight of climate-related risks.

75% of the companies profiled in our research have an ISO 14001 Environmental Management Certification. Alongside Siemens, top players in environmental benchmarking are certified with ISO 14001 standard environmental certification and score well above 70%. In addition, highlighting the poor response to water recycling and renewable energy consumption disclosure, none of the companies in the wind energy generation industry profiled in our research have publicly revealed the volume of water recycled in their operations. In terms of setting renewable energy consumption targets, less than 40% of the companies profiled in our research have renewable energy targets. None of the top three companies, barring Siemens, have a target to increase renewable energy consumption in their processes. Overall, all companies that are a part of this industry strive to be environmentally responsible, with all of them having TCFD disclosures.

With respect to environmental benchmarking, the following chart compares the scope 1 and scope 2 emissions of the top three companies in this category:

Social Insights

A social metric is associated with measuring a company’s relationship with its workforce as well as the communities in which it operates, followed by how it deals with solving political issues with employees. Specific metrics such as employee satisfaction, employee productivity, and employee feedback aid in measuring social metrics. The World Economic Forum (WEF) identifies gender wage equality, inclusion & diversity, incidence of child labor & forced labor, workforce health & safety, and hours of training provided as core metrics to examine the social stability of a firm.

Our proprietary framework finds the top three companies in the social benchmarking to score well above 65%. Among these, Iberdrola S.A. scored the highest, with a social score above 80%. Furthermore, Iberdrola has around 90% of its employees covered by occupational health, according to the company’s internal audit in 2020, and it has most of its sites certified by ISO 45001 & 18001.

All companies in this sector, including Iberdrola S.A., fare arguably well in terms of solving political issues with their stakeholders as well as having a positive relationship within the communities in which they operate. In line with this, all the companies in this sector have implemented a human rights policy across their supply chains to prevent forced labor and emphasize career development, enabling the growth of employees & the organization. In terms of gender pay gap disclosure, 75% of the companies in the industry have disclosed the pay gap in their firms.

Most companies prioritize the health & safety of their employees, including mental health, through policies and programs targeted at improving employee satisfaction, according to our research. Aker, for instance, provides safety training alongside mental health webinars to ensure employee well-being. Orsted offers health insurance coverage to its employees, whereas Siemens Gamesa Renewable Energy S.A. has a safety & environment policy to ensure employee health & safety.

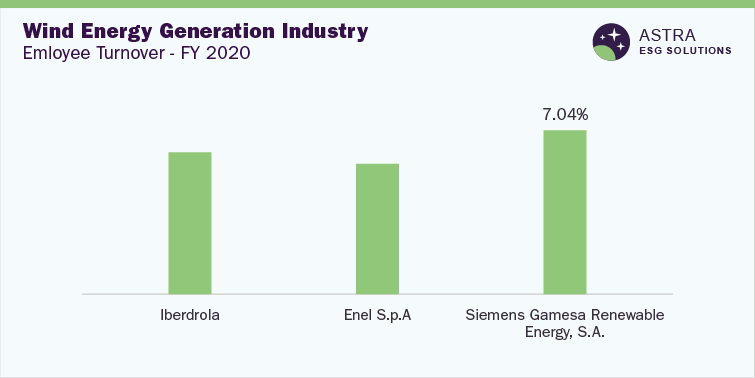

Enel S.p.A has an insurance policy for its employees traveling abroad and a statement of commitment to worker health and safety, which has resulted in lower employee turnover compared to its competitors (for the FY2020). Enel S.p.A, which has an overall ESG score of around 80%, recorded the lowest turnover rate of 7.04% in FY2020 compared to companies like General Electric, which have neither disclosed health & safety programs for their employees nor the turnover rate recorded in FY2020. Moreover, Enel S.p.A recorded a lower accident frequency rate compared to its peers in FY2020, with a single fatality in 2020, whereas Siemens Gamesa and other industry leaders recorded four each in 2020.

The following chart provides information on the employee turnover among the top three companies in the social category:

Governance Insights

Governance metric in ESG is related to decision-making factors in the organization, mainly referring to sovereignty in policymaking and the share of responsibility & rights held by various participants in the corporation, including stakeholders, managers, and shareholders. According to our proprietary ESG scoring model, Vestas Wind Systems and Enel S.p.A. rank the highest in our governance score compared to other peers in wind energy generation industry, with an average governance disclosure score of above 90%.

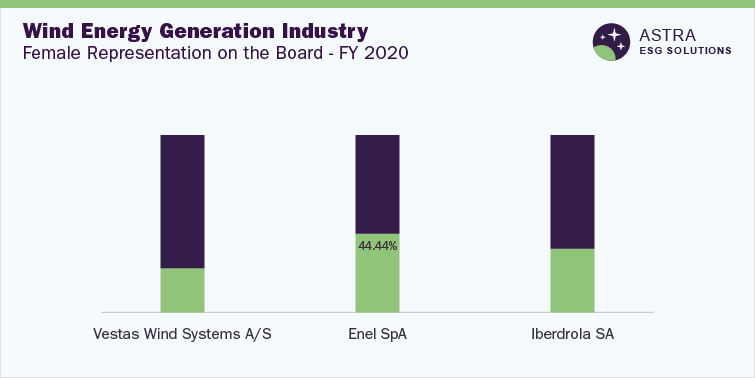

In this category, Enel S.p.A. has been identified as having the highest number of independent directors as well as female representation on the board compared to peers. More than 60% of the companies in this sector have implemented CEO succession planning, and more than 70% of the companies have targets to increase workforce diversity.

Most of the companies, including the top three wind energy generation industry leaders in this category, have institutionalized an innovative approach to managing cybersecurity risks in their operations, and more than 60% of the firms have appointed an executive to manage these risks in their companies. One of the leaders in this space, Vestas Wind Systems A/S, has created a cross-organizational cybersecurity program for improving the robustness of technical capabilities in the firm against cyberattacks.

Other companies like Iberdrola S.A. either have a cybersecurity risk policy or have developed cybersecurity risk initiatives, indicating their strong commitment to protecting confidential and publicly available data. Furthermore, seven out of eight companies have Business Continuity Programs (BCP) to protect their businesses & employees, thereby showing a strong commitment to delivering products at predefined levels without compromising on quality.

The following chart provides the percentage of female representation on board among the top three companies in the governance benchmarking:

Country-level Insights

Wind energy has a significantly lower impact on the environment compared to solar energy. The enormous build of a typical wind turbine, based on its dimensions and wind speed, helps it generate a larger output of energy proportional to the input. However, its expansive nature poses a significant threat to biodiversity by being fatal for birds and creating noise pollution due to the unpleasant sound during operation.

Despite the negative impacts of wind energy, its utilization has continued to increase across the globe as of 2021. Countries, namely the U.S., India, and China have created several policies for promoting the use of wind power and addressing environmental concerns.

India has policies aimed at attracting investments for wind energy, such as the Integrated Energy Policy (2006), created to govern lands for installing wind farms, the National-Solar Hybrid Policy, and other policy frameworks that are under development by the Government of India (GoI) in conjunction with the National Institute of Wind Energy. The GoI has allocated around USD 141 million for R&D into wind power generation as part of the Union Budget for FY 2022-23.

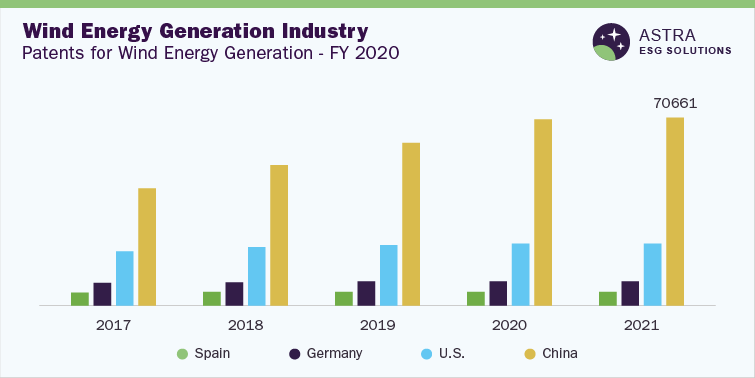

Technological innovations to increase the generation of clean energy from wind power have rapidly increased in recent years with the development of Quiet Wind Turbines, Airborne Wind Turbines, and Vertical Axis Turbines, among others. Further innovations in this space are expected to enhance the existing wind turbine infrastructure across nations and increase the filing of patents globally. In 2021, more than 100,000 patents were filed across the globe, with China leading with more than 70,000 patents.

Market Overview

As of 2021, the global wind power market was valued at around USD 99.28 billion and is expected to continue to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% between 2022 and 2030. The growing need for the replacement of conventional resources with renewable energy strongly generates the demand for wind power. Furthermore, wind energy, alongside solar energy, is more cost-effective compared to other sources of energy, such as gas & coal plants.

The power energy industry & electricity industry remain key drivers of the growth of wind energy generation and consumption. Geographically, the Asia Pacific region has a 42% market share in terms of revenue for newly installed offshore and onshore wind power capacity, which is expected to drive the demand for generation & consumption of wind power. Meanwhile, China and the U.S. together accounted for 60% of onshore installation capacity in 2021.

In terms of the application of wind energy, the utility sector accounted for around 85% of the market share as of 2021 when compared to the nonutility sector, which includes residential & commercial installations.

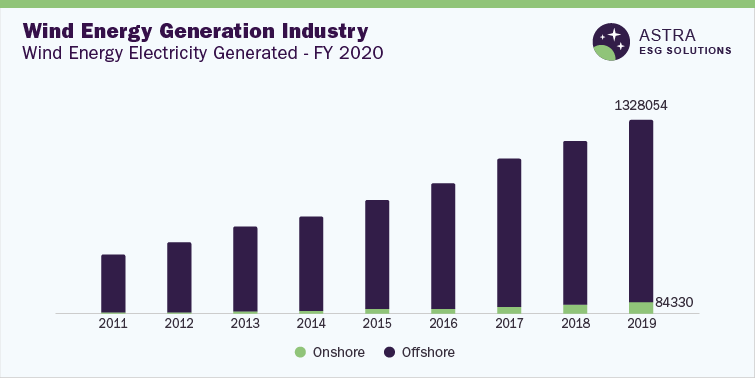

Overall, the demand for wind energy is growing with an increase in the generation of wind electricity, as depicted in the graph below. Equally, our research confirms that almost all the companies in this sector are conscious of sustainability and have made significant, transparent disclosures related to their ESG performance.