ESG Investing –Trends and Themes of ESG Investments and Stakeholder Concerns

Stakeholder concerns shaping ESG Investments

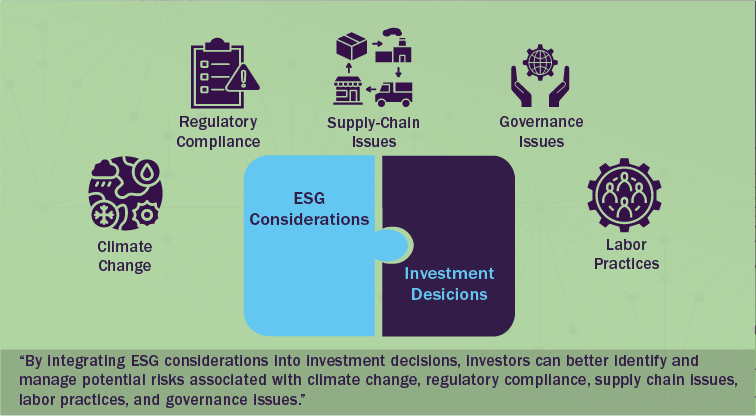

ESG (Environmental, Social, and Governance) investments have become increasingly important in today's world as they offer several benefits which go beyond traditional financial considerations. By integrating ESG considerations into investment decisions, investors can better identify and manage potential risks associated with climate change, regulatory compliance, supply chain issues, labor practices, and governance issues. Therefore, to build a positive reputation and enhance their brand value, companies are motivated to hold strong ESG performance in the market.

Additionally, ESG investment responds to the growing expectations of various stakeholders, including customers, employees, communities, and investors themselves, which increasingly demand transparency, ethical conduct, and accountability from businesses. Data from 2021 suggests that while 79% of investors started to believe that ESG risks play an important role in investment decision-making, 49% of investors have also shown a strong stance towards divesting from the companies which are not putting efforts towards ESG issues. By investing in companies that meet these expectations, investors can align their investments with the values and interests of their stakeholders, thereby fostering trust and loyalty. ESG investors are also better positioned to navigate regulatory changes and ensure compliance by integrating these factors into their investment decisions as ESG investing aligns with evolving regulatory and legal frameworks that emphasize sustainability and responsible business practices.

ESG Investing Forecast

It is anticipated that ESG-mandated assets are expected to constitute almost half of all professionally managed global assets by 2024. While non-ESG-mandated assets out of global assets under professional management are expected to drop to USD 71 trillion in 2024 from USD 72 trillion, ESG-mandated assets are expected to grow by USD 13 trillion from 2023 and reach USD 80 trillion in 2024. This ongoing increase in sustainability-mandated investment has provided numerous opportunities for investment management firms to revise their scales and offerings for exceeding client expectations. Additionally, stakeholders interested in ESG investments are attentive to understanding the growth of ESG products over the past years, which assists them in drawing opinions and future projections of potential ESG themes, and such client demands play the most significant role in developing investment managers’ preferences for sustainability metrics in decision-making. Hence, the global ESG asset under management (AUM) is expected to surpass USD 53 million by 2025, which will be more than a third of the total AUM at USD 140.5 trillion.

Let our sustainability consultants help you with your ESG goals. Share your queries and request a call back

Sustainable Finance Disclosure Regulation (SFDR) is one of the key driving factors for this expected transition of global assets as SFDR has created three fund designations, Articles 6, 8, and 9, based on the worldwide inclusion of ESG characteristics in investment decision-making. Apart from SFDR, the Organization for Economic Cooperation and Development Guidelines for Multinational Enterprises and the United Nations Global Compact form part of the widely used metrics in ESG investing.

Organizations Shaping ESG Investing

-

The Global Reporting Initiative

The Global Reporting Initiative (GRI), headquartered in the Netherlands, is an independent international organization that has developed the most widely recognized framework for sustainability reporting. GRI provides guidelines and standards for organizations to report on their economic, environmental, and social performance. The aim of GRI is to promote transparency, accountability, and comparability in sustainability reporting.

-

The Taskforce for Climate-related Financial Disclosures (TCFD)

TCFD is an initiative established by the Financial Stability Board (FSB) in 2015. Its purpose is to develop recommendations for consistent and comparable climate-related financial disclosures by companies. The TCFD aims to help organizations effectively assess and disclose the potential risks and opportunities associated with climate change.

-

The Sustainability Accounting Standards Board (SASB)

SASB is a U.S. based independent nonprofit organization that focuses on developing industry-specific sustainability accounting standards. SASB's mission is to enable businesses to identify, manage, and communicate financial material sustainability information to investors.

-

Climate Disclosure Standards Board (CDSB)

CDSB is also an international non-profit consortium of businesses and environmental NGOs that focuses on providing quantifiable information for investors and financial markets through the integration of climate change related knowledge performance indicators into mainstream financial reporting. CDSB has laid the foundation for TCFD and has brought together significant disclosure practices such as mainstream disclosures in 10-K filings or integrated reports.

Significant ESG Themes for 2023

-

Climate Action

Climate change presents both risks and opportunities for businesses across various sectors and is one of the most important trends for 2023. ESG investors consider the physical risks associated with climate change on the business, such as extreme weather and resource scarcity. They also tend to assess transition risks under the climate action trend, which include policy and regulatory changes, shifts in market demand, and technological advancements. In addition to the transition risks, ESG investors also recognize the opportunities arising from the transition to a low-carbon economy by adopting measures such as the use of renewable energy and energy efficiency solutions in operations.

-

Diversity, Equity, and Inclusion (DEI)

ESG investors recognize the importance of diverse representation in corporate leadership and the broader workforce. This includes gender diversity, ethnic and racial diversity, as well as diversity in terms of age, background, and skills. In 2023, investors focusing on this trend have shown a preference for companies that prioritize diversity and inclusivity in their hiring practices, promotion strategies, and talent development initiatives, along with factors such as pay parity and pay equity.

-

Clean Supply Chain

The clean supply chain trend is gaining momentum and refers to the growing emphasis on sustainability and environmental considerations throughout the entire supply chain process. Companies are increasingly prioritizing sustainable sourcing practices, ensuring that the raw materials and components used in their products are obtained in an environmentally and socially responsible manner. This includes assessing suppliers' environmental and social performance, promoting fair trade practices, and minimizing negative impacts on local communities and ecosystems.

-

Circular Economy

This trend economy emphasizes the efficient use of resources by reducing waste and optimizing resource consumption throughout the product lifecycle. This involves designing products for durability and using durable infrastructure for production, repairability, and recyclability, as well as promoting the reuse, refurbishment, and remanufacturing of products to extend their lifespan.

-

Employee Benefits and Well-being

Employee well-being is another ESG trend to watch in 2023, which has helped companies to realize the power of a healthy and happy workforce in achieving business success. The measures under this trend include providing access to mental health services, promoting work-life balance, and offering wellness programs.

-

Diversity and Independence of the Board of Directors

Corporate governance is also an important ESG trend to watch in 2023. Companies are now realizing that good governance is imperative for building goodwill and trust with investors, customers, and other stakeholders. This includes ensuring that boards of directors are diverse and independent, and that there are effective mechanisms in place for oversight and accountability.

To schedule a free market intelligence database demo, please complete the form below:

Recent Posts

Financial Inclusion and Smallholder Banks - Trends in Financial Inclusion and Accessibility to Marginalized Communities

ESG Investing –Trends and Themes of ESG Investments and Stakeholder Concerns

South Asian Giants in ESG - Sustainability Initiatives, Regulations and Policy Landscape in China, Japan, Singapore

Climate Tech Industry – Investments, Trends, and Challenges

New Sustainability Regulations and Implications for Europe (As outlined in European Commission Work Programme)

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPR norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.