Regulatory Intervention for ESG Ratings: EASRA’s Position and the Significance of Regulations for ESG Rating Providers

ESG (Environmental, Social, and Governance) ratings are one of the simplest yet most comprehensive methods available to evaluate the sustainability and ethical practices of a company. ESG ratings or scores, presented in the form of a numeric or an alpha-numeric rating, are provided by an ESG rating agency or ESG rating providers using certain frameworks and methodologies. Similar to credit ratings, which assess the performance of a firm based on financial factors, ESG ratings evaluate a firm’s non-financial performance, including its environmental impact, social practices, and governance practices.

Serving as a fundamental to ESG ratings, ESG metrics emerged in the early 2000s. Post 2010, ESG investing gained rapid pace with the establishment of the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-related Financial Disclosures (TCFD), and the Global Reporting Initiative (GRI). Today, various agencies and organizations have come up with methodologies based on ESG criteria for assessing ESG performance to provide ESG ratings or ESG scores for a firm.

The Rise in Demand for ESG Ratings

The rising demand for ESG information has continued to affect the ability of ESG data providers to offer accurate and detailed ESG data. Recent studies indicate the rising demand for ESG ratings globally, specifically in Europe. However, ESG ratings have evolved to provide quantifiable, standardized, and comparable ESG information for stakeholders to promote ESG integration.

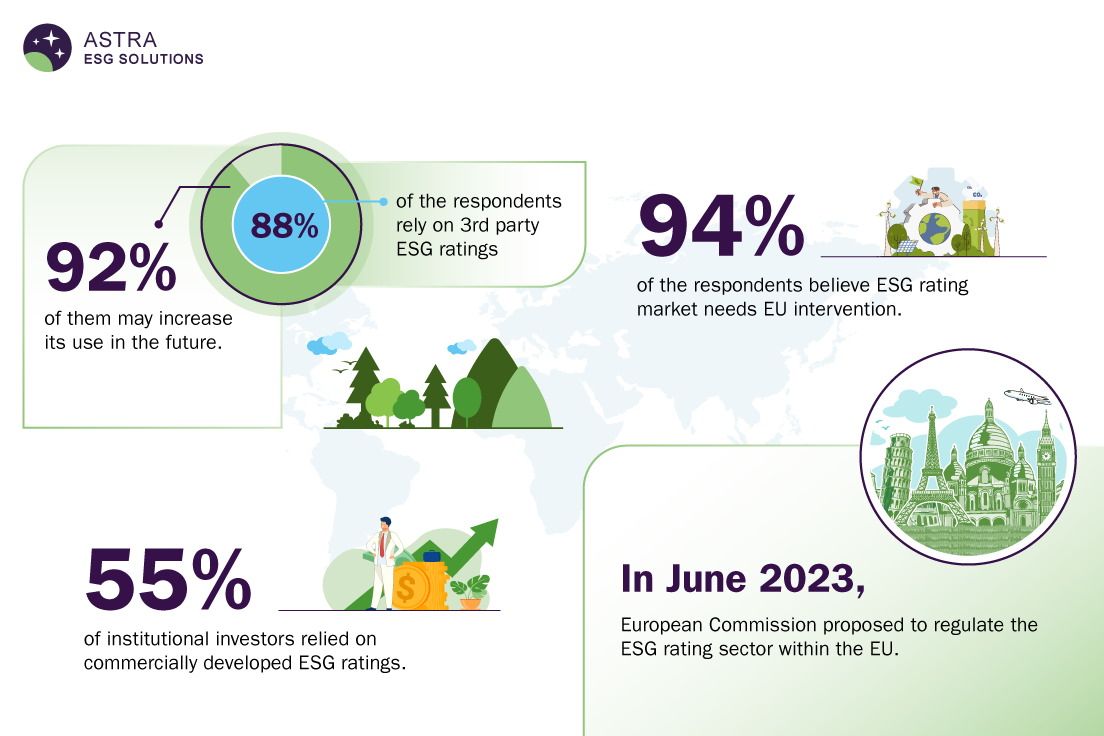

Commercially developed ESG ratings provided by third parties have been preferred by diverse stakeholders to meet the demand for ESG information. In May 2022, Ninety One, a global investment manager, conducted an in-person, ESG-focused survey at FundForum, the largest gathering of investment professionals in Europe. The survey revealed that 88 percent of the respondents rely on third-party ESG ratings, and 92 percent of them may increase its use in the future, either as a part of the investment process or to support their investment decisions.

Organizational investors rely the most on ESG ratings to determine a firm’s ESG performance. In SustainAbility’s survey conducted in 2020, 55 percent of institutional investors relied on commercially developed ESG ratings for gauging the ESG performance of a firm alongside involvement in direct company engagement. Furthermore, independent research in 2019 revealed that mutual funds having higher ESG ratings, had higher inflows in comparison to outflows observed in firms with lower ESG ratings.

Overall, the demand for ESG ratings has increased primarily across investment firms in response to which countries all over the world are adopting mandatory ESG disclosure legislations to improve the supply of ESG information to stakeholders.

Let our sustainability consultants help you with your ESG goals. Share your queries and request a call back.

The Need for Regulation in ESG Ratings

Despite rapid advancements in the ESG investment landscape and the popularity of ESG rating services, concerns such as the reliability and transparency of ESG ratings and a lack of rules in the industry to prevent the creation of conflicts of interest exist. In a 2022 survey conducted by the European Commission to understand the functioning of the ESG ratings market, 84 percent of the respondents in the survey raised concerns about the functioning of the market, deeming it unsatisfactory or “not functioning well.” In addition, 94 percent of the survey’s respondents agreed that the ESG ratings market needs regulatory intervention from the European Union (EU) due to prejudice and a lack of transparency with the methodology used by ESG rating providers for ESG reporting.

Following this, since 2022, at least four securities regulators, including the Securities Exchange Board of India (SEBI) and the European Securities and Markets Authority (ESMA), have made proposals to regulate the ESG ratings sector.

In June 2023, for the first time in the ESG ratings industry, the European Commission proposed to regulate the ESG rating sector within the EU. The proposal aims to enable investors to make better financial decisions, reduce the capital cost for sustainable firms, prevent conflicts of interest, and assist benchmarking agencies in using ESG ratings carefully. Furthermore, the commission has proposed subjecting ESG rating entities to supervision and authorization by the ESMA.

On the other hand, SEBI’s proposed consultation paper in 2022 outlined the need for specific Indian ESG Rating Providers for the Indian market to improve the differentiation of ESG Rating Providers within India. SEBI’s framework also called for the accreditation of ESG Rating Providers, the application of ESG rating scales, the adoption of a proper rating process, the disclosure of ESG rating reports, and the use of a subscription pay model, among others, for standardizing the operation of ESG Rating Providers in India. In essence, SEBI aims to create a reliable, interpretable, and comparable ESG rating system in line with emerging global standards.

Regulatory intervention in the ESG ratings space improves transparency in reporting and creates a platform for ESG Rating Providers to be widely accepted among financial institutions and corporates. However, despite helping the market to ‘function well,’ regulations may impede the ability to innovate among ESG Rating Providers.

The Future of ESG Rating Providers and Impact of Regulatory Intervention - EASRA and IEEFA’s Position

Globally, regulatory frameworks for ESG ratings are still in their infancy and have been evolving with increased attention from regulators. While regulatory intervention may improve the reliability and transparency of ESG ratings, certain market participants consider regulatory frameworks to increase operational costs and curb innovation in the ESG ratings sector. Such is the stance of associations, including the European Association of Sustainable Rating Agencies (EASRA) and the Institute for Energy Economics and Financial Analysis (IEEFA).

In early January 2024, the EASRA, an association representing sustainable finance service providers in Europe, provided a different angle to the debate by considering the impact of the regulation on emerging ESG rating providers in the market. The EASRA seeks the administrative principles and rules designed by the European Commission to help create a level playing field for small and medium-sized rating providers to facilitate their competitiveness in the industry. They also seek the inclusion of ESG data providers who use models and estimations within the scope of the regulation alongside ESG Rating Providers.

The IEEFA deems regulation crucial for increasing the confidence of participants in the ESG ratings market. This will not only help increase the relevance of ESG ratings globally but also protect investors from potential risks associated with the performance of a firm. However, a principle-based regulation might offer ESG rating providers with the flexibility to adapt to the changing trends in the market and sustain innovation, which is equally important for emerging players in the market to help them achieve a competitive advantage.

Recognizing the significance of regulations for ESG ratings, the European Federation of Financial Advisers and Financial Intermediaries (FECIF) commended the EU’s attempts to promote trust and transparency of ESG ratings. In turn, the federation recommended a balanced regulation that is aligned with global standards, enhances transparency, and avoids implementation challenges considering the global nature of the financial market and the nature of its participants.

Overall, the EU’s decision to regulate the ESG ratings market is a cornerstone in the ESG landscape, considering its significance for market participants and the financial industry. Apart from improving the reliability, standardization, and transparency of ESG ratings, this provides global recognition for ESG Rating Providers and promotes investor confidence.

Nevertheless, innovation and the need for a competitive market (as per the EASRA’s stance) may transpire dynamic changes before standard regulatory procedures are institutionalized globally amidst the probable implementation challenges.

Check out Astra's portfolio of Sector-Wise ESG Thematic Reports covering 100+ industries

How Astra can help

Astra’s ESG taxonomy integrates fundamental & alternative, industry-specific, and industry-agnostic Key Performance Indicators (KPIs) that promote appraised scoring for ESG Rating Providers and other small, medium, and large industry players. These KPIs are developed in line with the leading ESG frameworks and standards, such as - GRI, SASB, CDP, and UN SDGs, to benchmark organizations and industry operations based on their operations. Astra can support ESG Rating Providers in the following ways:

-

ESG Data Collection, Aggregation, and Validation: We employ secondary data analysis to identify and analyze ESG data based on reliable, publicly available sources. Our resources employ technologically advanced automation techniques, comprehensive analytics, and collective intelligence to segregate and validate ESG data. We help private and public companies track and compare ESG KPIs and trends across individual companies and industry verticals.

-

ESG Gap Analysis and Peer Benchmarking: We leverage our ESG data to create interactive ESG performance reports of companies and their competitors for ESG Rating Providers and small and large businesses to analyze gaps in ESG integration.

-

ESG Advisory and Consulting Services: Astra can ensure progressive ESG integration into business decision-making and business operations of a firm through skill-building and continuous monitoring of ESG integration services.

To schedule a free market intelligence database demo, please complete the form below:

Recent Posts

Financial Inclusion and Smallholder Banks - Trends in Financial Inclusion and Accessibility to Marginalized Communities

ESG Investing –Trends and Themes of ESG Investments and Stakeholder Concerns

South Asian Giants in ESG - Sustainability Initiatives, Regulations and Policy Landscape in China, Japan, Singapore

Climate Tech Industry – Investments, Trends, and Challenges

New Sustainability Regulations and Implications for Europe (As outlined in European Commission Work Programme)

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPR norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.