Fundamentals of Astra - ESG Compliance and Metrics

ESG - Importance and Impact

ESG compliance is fast growing and exercises a significant impact on the business decisions of an organization to function smoothly. It is imperative that a corporation needs to adapt to the fast-changing needs of the market to continue through its dynamics, however, measuring the impact of the change and driving toward the right value is a real challenge. Moreover, to overcome business challenges, strategizing key aspects of the change remains pivotal. When it comes to ESG, there is more than meets the eye. On a broader scale, ESG is a non-financial performance indicator for decision-making, risk assessment, and investment evaluation, and business organizations are required to remain highly responsive to ESG disclosures toward their stakeholders and investors to be successful in reaching their objectives.

According to Bloomberg, investments in ESG would surpass USD 41 trillion by 2022 and USD 50 trillion by the end of 2025. Undoubtedly, the trajectory for high-growth for business organizations will be inclusive of regulatory challenges, compliance, and standardization. The 26th United Nations (UN) Climate Change Conference of the Parties (CoP26) which was recently hosted in 2021 at Glasgow, broadly indicated these challenges and highlighted climate change issues and risk mitigation plans.

ESG compliance and investments require a comprehensive approach to reduce the involved complexities, as one of the main challenges concerning ESG is benchmarking. Benchmarking techniques are one of the crucial parameters to understand a particular ESG framework. However, companies willing to implement the mandate measures often struggle with a broad spectrum of available frameworks, as they usually focus on combined aspects of ESG.

How can Astra Help

Astra employs a comprehensive methodology and approach for implementing the mandate measures and complying with the ESG norms. The key issues in ESG are identified through materiality analysis by taxonomists, followed by a thorough examination of leading business journals in the industry sectors. Data aggregation is based on several sources such as regulatory agencies, white papers, company filings, and analyst reports. In addition, data triangulation studies remain a pivotal theme covering aspects such as industry regulation, industry benchmarking, and SWOT analysis.

Astra’s ESG framework mainly accounts for three pillars: Environment, Social, and Governance, and the taxonomy committee periodically updates the framework based on market updates and relevant studies. Besides, the alternative ESG data remains inclusive of macroeconomic factors that remain significantly influential for the growth of respective sectors.

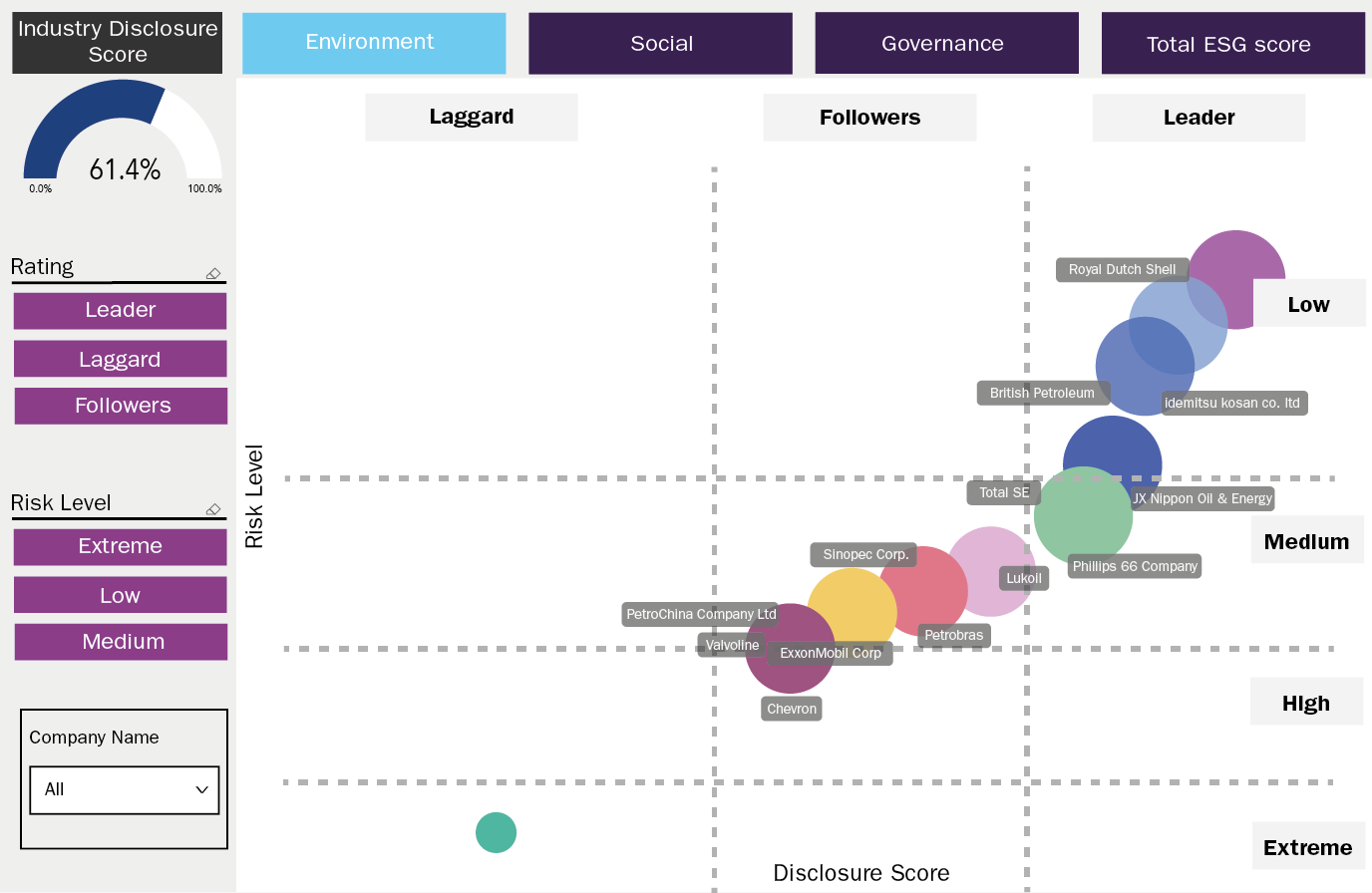

*Image extracted from actual ESG report dashboard

Astra provides a flexible business intelligence & ESG dashboard solution that consists most trending impact themes for both organic and inorganic growth, identifying industry-wide sustainability best practices, performance benchmarking, peer & trend analysis, ESG scores at the company-level generated through material ESG indicators, and access to multiple customized ESG thematic reports to aid in the robust analysis and strategic planning. It also includes a comprehensive assessment of both fundamental and alternative ESG information. The insights and data provided through this dashboard are aimed to equip project leaders and decision-makers with in-depth information and knowledge about the required ESG mandates relevant to their Industry sectors. This would enable them to shortlist and implement ESG strategies in order to build sustainable business practices.

To schedule a free market intelligence database demo, please complete the form below:

Recent Posts

Financial Inclusion and Smallholder Banks - Trends in Financial Inclusion and Accessibility to Marginalized Communities

ESG Investing –Trends and Themes of ESG Investments and Stakeholder Concerns

South Asian Giants in ESG - Sustainability Initiatives, Regulations and Policy Landscape in China, Japan, Singapore

Climate Tech Industry – Investments, Trends, and Challenges

New Sustainability Regulations and Implications for Europe (As outlined in European Commission Work Programme)

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPR norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.