Tracking the Right ESG Metrics

ESG metrics comprise the necessary flags where practitioners need to resolve the concerns that can create roadblocks to the overall smooth functioning of the organization. However, with the pursuit of metrics and parameters, tracking down the right metrics comprehensively can be a real challenge encountered by business corporations.

The metrics cover a broader aspect. Basic activities such as tracking down carbon emissions, electricity consumption, and resource utility are some of the common places to start. On contrary, the primary challenge is to identify the “right” metric for the organization. For example, the wastewater and wastewater treatment industry may indicate the usage of eco-friendly chemicals for residential washing and cleaning purposes. But if water is the prime ingredient of the entire operation, then it is practically hard to keep a check on water wastage at the filtering stages.

Some Crucial ESG Metrics

|

Environmental Pillar |

Social Pillar |

Governance Pillar |

|

Climate Change |

Human Capital |

Corporate Governance |

|

Natural Resources |

Product Liability |

Corporate Behavior |

|

Pollution & Waste |

Stakeholder Opposition |

Board Diversity |

|

Environment Opportunity |

Social Opportunity |

Business Ethics |

|

Carbon Emissions |

Labor Management |

Executive Pay |

|

Water Stress |

Product Safety & Quality |

Anti-competitive Practices |

|

Toxic Emissions & Waste |

Health & Safety |

Ownership |

|

Opportunities in Clean Tech |

Chemical Safety |

Corruption & Instability |

|

Product Carbon Footprint |

Financial Product Safety |

Accounting |

|

Opportunities in Renewable Energy |

Human Capital Development |

Tax Transparency |

Need for Efficiency in Sustainability Reporting

Although ESG practitioners have shown immense interest in sustainability reporting and following ESG frameworks, the methodologies, and approaches toward publishing sustainability reports are still a developing process for most organizations. Many reports reflect on organization initiatives and sustainability plans while the most effective report is the one that contains informational insights on the sustainability impacts and what directives are needed to keep those impacts at bay.

For instance, hydrogen generation industries may include fuel & energy consumption, and nature of logistics, etc., they often miss including metrics on supply chain impacts, and waste management, as these can be excluded from the reports, but in a broader scenario, these factors can indicate the measure of an environmental footprint of an organization.

Metrics Should Be Intrinsic to the Report

The purpose of ESG metrics is to enable a piece of full-fledged information about organizational plans to mitigate risks and the extent of resource consumption. The disclosures should also contain transparency on both, internal and external levels of businesses.

This eventually establishes a perfect tracking system at various layers within and outside of organizations and helps in optimizing the desired results because tracking the “right” metrics is an ideal way to maximize cost-saving and lessen the environmental impact. Furthermore, as ESG data contribute to revealing the functioning of a corporation, it also allows room for systems and product improvements in several ways.

Usage of ESG Dashboard Solutions Remains Pivotal

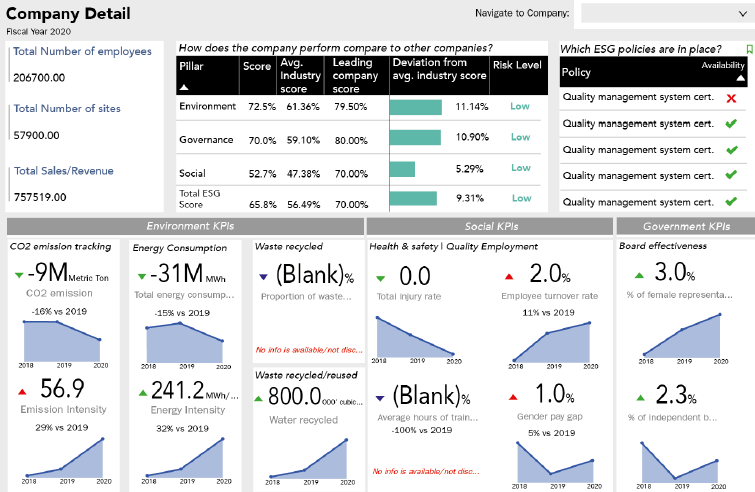

ESG metrics vary between many organizations and having a tool is one of the significant aspects to support a business function. Business intelligence software and dashboard solutions relay information on both organic and inorganic growth, benchmarking, and comparative analysis can enable strategic planning to a greater extent.

*Image extracted from actual dashboard

Astra’s ESG Dashboard and Consultation Services provide an end-to-end view of a company or organization’s position in terms of ESG compliance. It includes details like what is the company’s current score for the Environment, Social and Governance pillars along with a comparison against the average industry score and the scores of the company leading the tally. It also gives a preview of the deviation from the average industry scores and the policies in place. This data can help organizations to zero down and prioritize the issues at hand and take corrective actions in order to build sustainable business practices.

Conclusion

The significance of ESG metrics to corporate sustainability reporting is on the higher end as investors and shareholders demand more information on disclosures. As such, there can be several ways or approaches to identify the “right” metrics to report sustainability, Astra’s ESG Dashboard Solutions can help you define and track ESG metrics and benchmarking with better comparisons.

To schedule a free market intelligence database demo, please complete the form below:

Recent Posts

Financial Inclusion and Smallholder Banks - Trends in Financial Inclusion and Accessibility to Marginalized Communities

ESG Investing –Trends and Themes of ESG Investments and Stakeholder Concerns

South Asian Giants in ESG - Sustainability Initiatives, Regulations and Policy Landscape in China, Japan, Singapore

Climate Tech Industry – Investments, Trends, and Challenges

New Sustainability Regulations and Implications for Europe (As outlined in European Commission Work Programme)

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPR norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.