Report Overview

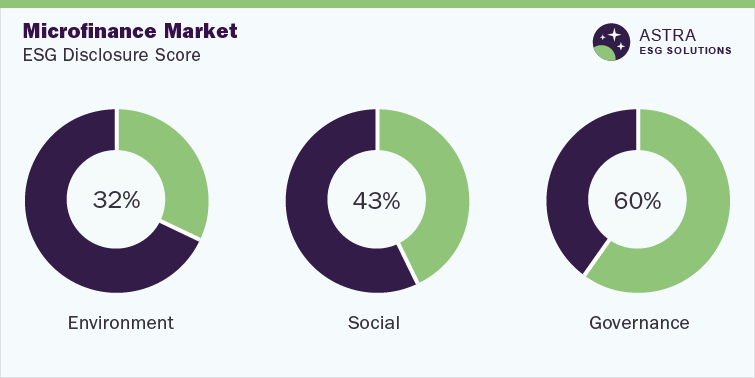

The average ESG disclosure score for the microfinance market stands between 40% and 50%. This conclusion has been derived from a detailed analysis of Environmental, Social, and Governance (ESG) parameters within our robust ESG scoring framework. Through our research, we assessed L&T Financial Holdings, Banco de Bogota, and six other global market leaders in the microfinance industry.

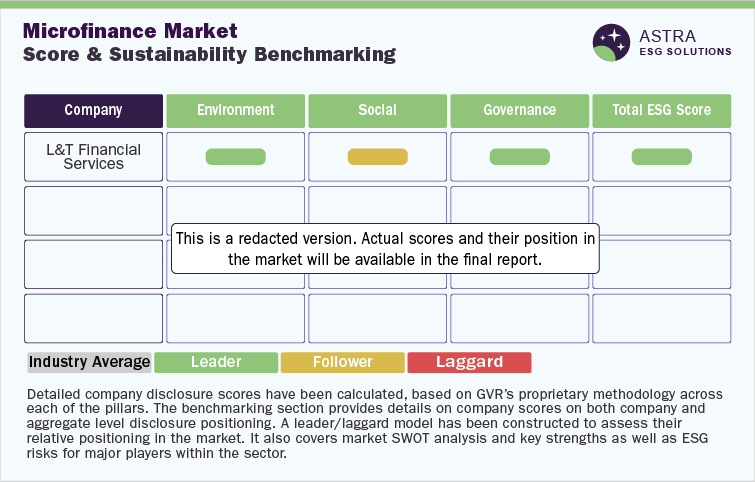

As per our research, only four companies, including L&T Financial Holdings and IIFL Finance, scored above the average industry score. On the other hand, four other companies are lagging in terms of reporting and disclosures, according to our analysis. Furthermore, the research concluded that more than half of the ESG disclosures have been made around the governance pillar, with L&T leading the course in the sector.

Environmental Insights

Microfinance plays an important role in social inclusion and economic growth, but it also creates a direct impact on the environment through its operations. Microfinance organizations can improve energy consumption disclosure within their operations and switch to cleaner alternatives for fuel and energy consumption. This can improve their environmental performance, as the lack of solid environmental stewardship has affected the overall environmental score in this industry. In addition, microfinance or microcredit organizations can have an immense impact on the way many rural and agrarian communities address their environmental issues, as the core objective of microcredit is to improve the livelihood of people living below the poverty line.

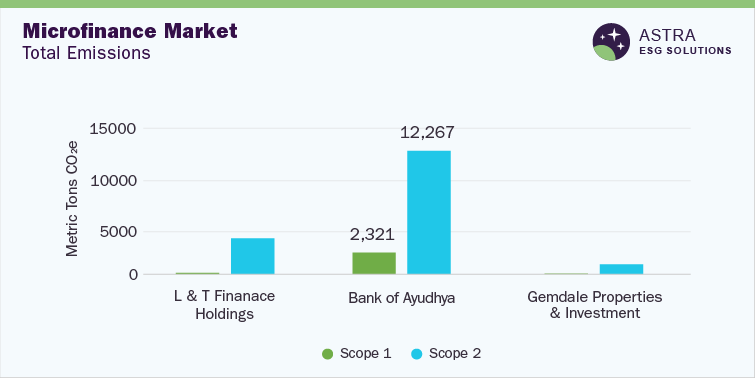

L&T Finance Holdings, Bank of Ayudhya, and Gemdale Properties & Investment scored the highest disclosure score in the environmental pillar. In our research, it was observed that the Bank of Ayudhya had the highest scope 1 and scope 2 emissions for the reporting year 2020 and Bank of Ayudhya had the highest energy consumption & intensity for 2020. However, Gemdale had the lowest emission intensity and low energy consumption due to the presence of emission reduction targets and better workflow activities for reducing emissions.

In the top three companies in our research, only L&T Finance Holdings and Gemdale Properties & Investment have been ISO 14001 certified while the Bank of Ayudhya has not disclosed any evidence of an ISO 14001 certification. However, the top three companies have waste & water management systems in place to ensure responsible consumption and disposal. For example, the Bank of Ayudhya has a zero-waste initiative, the Krungsri Right Place, Right Bin, which educates employees on how to responsibly sort and dispose of trash. Similar sorting policies are followed by Gemdale as well.

Social Insights

The emergence of microcredit facilities is helping drive social and financial inclusion. Through microfinance facilities, banking has become more accessible to disadvantaged rural and agrarian communities. Microfinance drives socioeconomic development by alleviating poverty, making it easy to get loans, and helping poor workers avoid the vicious trap of private moneylenders.

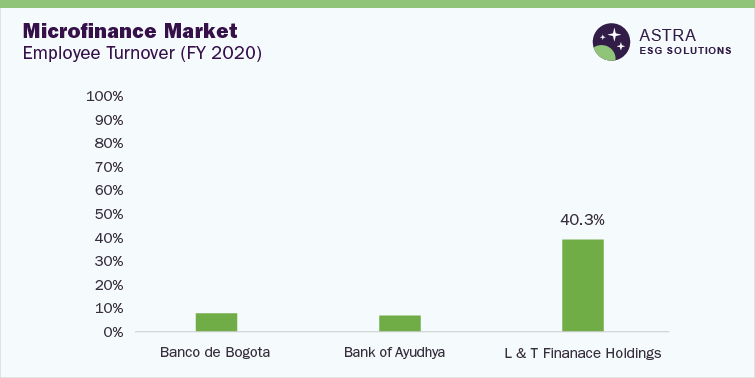

According to our holistic report, Banco de Bogota leads among the eight companies evaluated for microfinance in the social pillar with a score of around 65%, followed by the Bank of Ayudhya. As per our research, L&T Finance Holdings reported the highest turnover, whereas the Bank of Ayudhya reported the lowest. Similarly, Banco de Bogota reported the highest employee training hours, while L&T Finance Holdings reported the lowest.

As per our observations, none of the top three companies has any disclosure on safety certifications. However, all three companies have a supplier human rights policy in place, adhering to human rights standards and engaging in ethical business practices. Furthermore, the top three companies have disclosed evidence for conducting and reporting customer surveys or customer satisfaction evidence in their public data.

Governance Insights

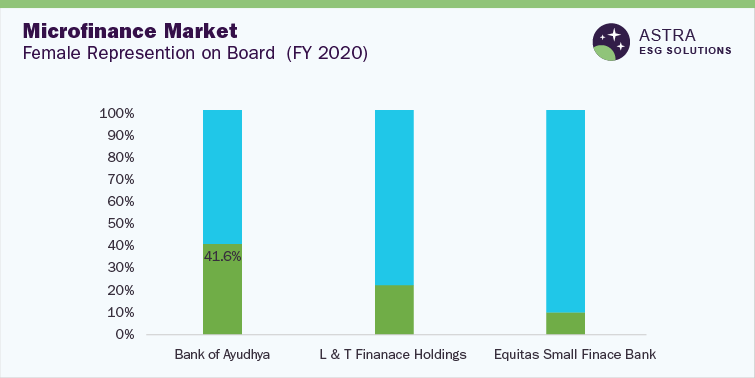

The Bank of Ayudhya, L&T Finance Holdings, and Equitas Small Finance Bank are the top three banks in terms of governance disclosure. These banks scored more than 70% in their disclosures.

For the reporting year 2020, the Bank of Ayudhya had the highest representation of women on the board, while Equitas Small Finance Bank had the lowest. Suggestively, the Bank of Ayudhya introduced initiatives to increase female representation on the board, which is visible through its current female representation. As per our research, Equitas Small Finance Bank reported the highest percentage of independent board members for 2020, whereas the Bank of Ayudhya reported the lowest.

Cybersecurity and data privacy are crucial tipping points for a business to support strong governance practices. As banks hold many important data, governance is an important pillar in ESG for banks to consider. All the top three companies have robust cybersecurity guidelines, provisions, and principles set in place to avert any risk the company might face in terms of security. L&T Finance Holding integrated cybersecurity into IT security policies & procedures supported by programs for employee education and training.

Similarly, the top three companies have robust business continuity plans, along with succession planning, to prepare for any unforeseen events and smooth transitions in the company without disturbing the operational flow.

Country-level Insights

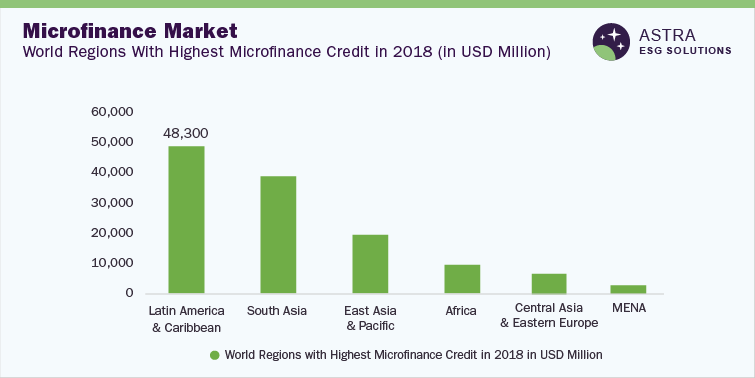

Microfinance Institutions (MFIs) have witnessed an average growth of 11.5% over the past 5 years. In 2018, around USD 124 billion was lent by 916 MFIs, according to the MIX Market figures disclosed by the financial service providers. Approximately 39% of this amount was borrowed in the Latin America & Caribbean (LAC) region, followed by South Asia, with India, Bangladesh, and Vietnam having the highest number of borrowers. In India, microfinance aided rural employment and increased the earning potential for women with a range of activities. In terms of countries leading in the global microfinance market, India has emerged as a leader with respect to borrower power.

The LAC is the second-largest region in the microfinance sector in terms of the number of borrowers, with women accounting for most of the total borrower population. Compared to South Asia & Latin America, countries across Europe, the Middle East, & Central Asia are still growing in terms of credit portfolio and number of borrowers.

East Asia and the Pacific region experienced an increase in the number of clients since 2012. Similarly, the African continent has significantly contributed to the growth of financial inclusion in the region, with a majority of the population having a bank account owing to growth in the adoption of digitalization in the continent. The regions like Central Asia and Eastern Europe, along with the Middle East & North Africa (MENA), make statistically smaller contributions to the microfinance sector. However, the MENA region registered a significant increase in outstanding loans offered in 2018 since 2016.

Market Overview

The World Bank estimates that more than 500 million people have directly/indirectly benefited from microfinance-related operations and in India, there were around 66 million borrowers as of 2023. India’s microfinance market has grown by 21% in FY 2023 compared to FY 2022. The players in this market have been advantaged by a level playing field created by new regulatory norms in the country.

Furthermore, the International Finance Corporation (IFC) has helped establish or improve credit reporting bureaus across developing countries. Microfinance services include microcredit, fund transfers, savings accounts, microinsurance, and checking accounts. The MFIs have helped define the way credit lending takes place across the world and made financial aid more inclusive for the marginalized sections of society.

As of 2021, many leading global Private Equity (PE) firms have invested in Indian MFIs. The British International Investment led the consortium of global investors, and it invested INR 196 Crores (USD 23.53 million) in an Ahmedabad-based institute, Light Microfinance. As an innovation, microfinance led the way in social inclusion and financial accessibility, with millions of people using phones to perform banking & financial transactions.