Three Major Significances of ESG in the Corporate Environment

Corporatism involves a vast number of policies at the organizational level that structure and define the rights and responsibilities of interest groups and stakeholders. The interest groups may comprise of external shareholders and investors. Investors have a particular interest in the organization's performance and profits whereas the stakeholders are the directors and key people who maneuver the business and have a huge say when it comes to policy formation and implementation. Moreover, there are rules & regulations, and management methodologies involved in the decision-making process of the company, and as a result good corporate governance establishes faith and trust between investors and stakeholders of the company.

However, today, investors not only invest in profitable companies but also look for organizations that hold good corporate citizenship driven by bearing responsibilities toward the environment, practicing business ethics, and following effective risk management and business sustainability strategies.

In terms of business, the industries such as Hydrogen Generation, Electric Passenger Vehicles, and several others are widely embracing sustainable business practices to respond positively to the dynamic changes at the global level and achieve ESG compliance. Mentioned below are three significant reasons to incorporate ESG in the corporate environment.

Encourages Value-based Investing

Corporate investors possess a higher level of awareness about the companies they choose to invest in. Just because a profitable venture has had good profits, it does not necessarily conclude that they have good corporate governance. Prior to zeroing down on any investment some common questions to be asked are,

- What initiatives the company is undertaking to reduce its carbon footprint and is it enough?

- To what extent are the business ethics followed?

- What are the risky portfolios, and what strategies to minimize their impact?

The ESG frameworks address the concerns about the functioning of the corporation. Besides, having an ESG framework is one of the best methodologies to facilitate value-based investing.

Promotes Transparency in Corporate Disclosures

For corporates, ESG is becoming a mandate, Being a non-financial indicator it relays a huge impact on corporate governance as ESG disclosures can assist corporations to evaluate potential risks and opportunities for the foreseeable future. According to multinational research, the EU Non-Financial Reporting Directive has mandated that large corporations and ventures reveal information on their development and initiatives, and the impact of their activities pertaining to ESG. On the flip side, these groups must provide clear statements with detailed reasons for not pursuing ESG policies.

Increases Brand Value

Globally, every business entity or corporation follows ESG frameworks in their best capacity. Besides, the pursuit of ESG metrics and policies varies from region to region. Many companies acknowledge that incorporating the ESG approach in their day-to-day activities can ensure cost reduction and risk mitigation along with producing new revenue streams. With an overall ESG strategy, corporates can keep investors and shareholders fully aware of their actions and results in the long term and expect an increment in the valuation of their respective brands in terms of consumer perception.

With the growing buzz of ESG throughout the business communities and the urgency to respond to the changing landscape of business methodologies, there is a need for comprehensive and flexible business intelligence & ESG solutions.

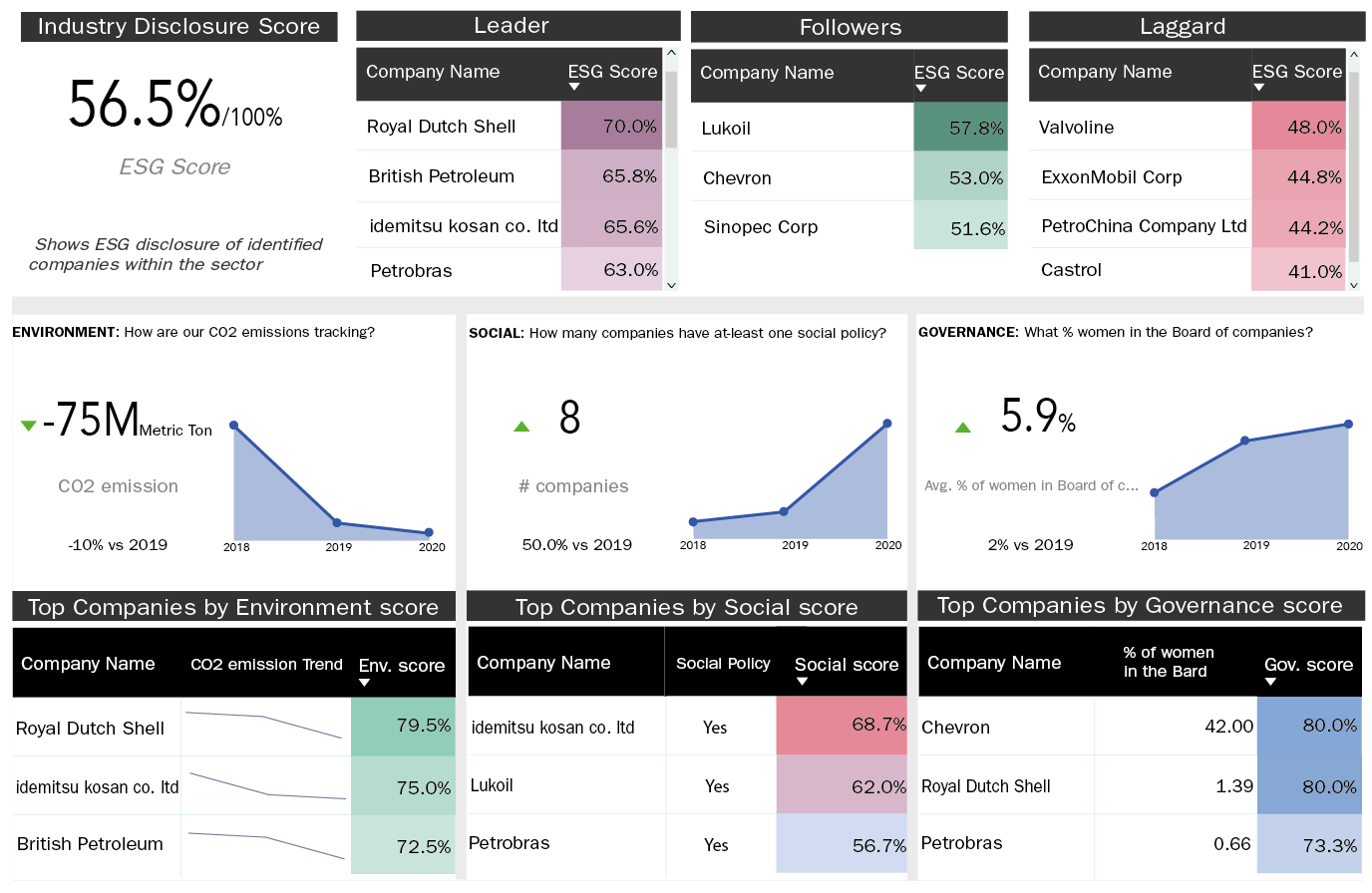

*Image extracted from actual dashboard

Astra’s ESG solution and dashboard comprise the most trending impact themes for both organic and inorganic growth, identifying industry-wide sustainability best practices, performance benchmarking, peer & trend analysis, ESG scores at the company level generated through material ESG indicators, and access to multiple customized ESG thematic reports to aid in the robust analysis and strategic planning.

To schedule a free market intelligence database demo, please complete the form below:

Recent Posts

Financial Inclusion and Smallholder Banks - Trends in Financial Inclusion and Accessibility to Marginalized Communities

ESG Investing –Trends and Themes of ESG Investments and Stakeholder Concerns

South Asian Giants in ESG - Sustainability Initiatives, Regulations and Policy Landscape in China, Japan, Singapore

Climate Tech Industry – Investments, Trends, and Challenges

New Sustainability Regulations and Implications for Europe (As outlined in European Commission Work Programme)

Service Guarantee

-

Insured Buying

This report has a service guarantee. We stand by our report quality.

-

Confidentiality

We are in compliance with GDPR & CCPR norms. All interactions are confidential.

-

Custom research service

Design an exclusive study to serve your research needs.

-

24/5 Research support

Get your queries resolved from an industry expert.